China’s economic and industry outlook for 2025

Technology, Media & Telecommunications

External Pressures Catalyze Technological Self-reliance

The most significant impact on the technology sector in 2025 will be the U.S. intensifying sanctions against China. However, this move is likely to trigger an acceleration of China’s self-innovation and domestic substitution efforts, strengthening fundamental research and the development of core technologies, and driving upgrades in domestic industries. Consequently, we expect the technology sector in 2025 to experience short-term disruptions but a cautiously optimistic long-term outlook. Semiconductors, artificial intelligence, and emerging technology sectors are set to become core focus areas, which are critical to strengthening China’s industrial supply chains.

Semiconductors: Domestic supply chain substitution to accelerate

The U.S. is expected to implement more aggressive technology policies towards China, focusing on the following key measures:

1. Diversified sanction measures: The U.S. may expand export controls to cover a broader range of products, not only targeting high-performance AI GPUs and quantum technologies but also extending to mid-range chips. Multilateral cooperation, in which the U.S. and key supply nations restrict China’s access to semiconductor manufacturing technologies, and limiting U.S. investments in key Chinese sectors, are also anticipated.

2. Tightened controls on Chinese capital: There will likely be intensified scrutiny of Chinese acquisitions of U.S. high-tech companies, particularly in advanced and strategic sectors, aimed at curbing the expansion of Chinese capital.

3. Higher tariffs: Tariffs on semiconductors and related tech sectors could be further raised. Recently, Trump indicated that the U.S. may impose an additional 10% tariff on nearly all Chinese imports, which would further strain Chinese exports.

Figure 1: Mature process chips drive China’s chip exports to grow against the trend

Source: The General Administration of Customs

Despite the pressure of these regulatory measures, Chinese semiconductor exports have shown resilient growth, particularly in the mid-to-low end of the market, where China holds a competitive advantage. With rapid technological upgrades, the semiconductor sector in China presents substantial growth opportunities:

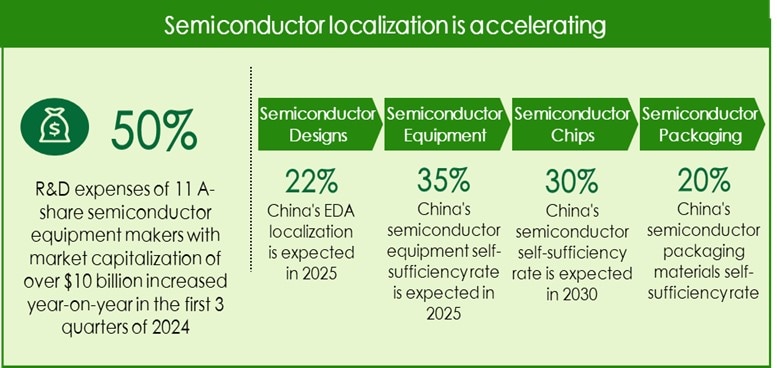

1. Accelerating Localization of Semiconductor Supply Chains: Following multiple rounds of export controls, China’s semiconductor equipment companies have significantly ramped up R&D spending. For instance, by the third quarter of 2024, R&D expenditure for 11 semiconductor equipment companies listed on China’s A-share market, each valued over 10 billion yuan, rose by 50%, representing 14% of their total revenue. By 2025, the domestic self-sufficiency rate in semiconductor equipment is expected to reach 35%. Similarly, the localization of China’s EDA (Electronic Design Automation) industry is accelerating, with the localization rate projected to rise from 6.2% in 2018 to 22% by 2025.

Figure 2: The semiconductor localization process is accelerating

Sources: Sci-Tech Daily, CSIA, Head Panther Research Institute, Goldman Sachs, ICP Capital

2. Policy Restrictions May Fall Short of Intended Effects: Despite multiple rounds of export controls, the revenue growth of U.S., Japanese, and Dutch semiconductor equipment companies in China has not decreased but instead has increased. In Q1 2024, more than 40% of U.S. semiconductor equipment exports went to China, and China accounted for 50% of Japan’s semiconductor equipment exports. This trend highlights the growing dependence of U.S. semiconductor companies on non-U.S. exports to circumvent domestic export controls, underscoring China’s continued role as a key business partner for the world’s leading semiconductor companies.

Artificial Intelligence: Continuous iteration and upgrades

AI continues to revolutionize industries, with 2025 poised to mark significant progress in its adoption and development:

1. AI agent applications to experience rapid growth: By 2025, we project that 25% of global companies using generative AI will pilot AI agents, with this figure expected to reach 50% by 2027. Major Chinese internet companies have launched AI agent strategies, positioning 2025 as China’s “AI Agent Year.” AI agents are expected to be applied in customer service (handling more complex queries than current chatbots and solving problems autonomously), cybersecurity (self-detecting attacks, generating reports, and identifying new vulnerabilities), compliance (analyzing regulations and company documents for compliance), and R&D (assisting with data analysis to enhance efficiency), accelerating China’s digital transformation and business model innovation.

2. AI to combat deepfakes: Currently, tech companies use machine learning models to detect patterns and anomalies in deepfake content. In September, China introduced its first technical standard for deepfake detection in the financial sector, which enhances security for identity verification and transaction validation in banking. By 2025, deepfake detection technology is expected to be widely adopted across industries, driving the cross-sector standardization and collaboration needed to build a comprehensive digital security ecosystem.

3. Generative AI as a differentiator for smartphones: In recent years, incremental innovations in smartphones have failed to capture the market’s attention. In response, leading manufacturers have incorporated generative AI into smartphones. By 2024, next-generation AI smartphones are expected to account for 15% of global smartphone shipments, with this figure forecast to exceed 30% by 2025. Currently, generative AI in smartphones is used primarily for real-time voice-to-text translation, document processing, global search, and image editing. In the future, new functions such as personalized assistants and more efficient multitasking capabilities will further drive market growth.

“Hard Tech”: Domestic innovation opens new frontiers

In response to external pressures, we expect several new technological sectors to develop rapidly, forming strategic pillars for China’s technological self-reliance:

1. Chiplet technology: Chiplet technology, which integrates smaller, higher-yield chips to improve performance and yield, is set to scale up. China has introduced its first native small chip standard, positioning Chiplet technology as a “shortcut” for overcoming technological gaps. By 2025, small chips are expected to see widespread applications in automotive, data centers, AI, and mobile communications.

2. Optical chips: With the rapid development of 5G, cloud computing, and AI technologies, the demand for high-speed, high-bandwidth communications is surging. As a core component of optical communication, the market for optical chips continues to grow, with China’s optical chip market expected to reach 17 billion yuan by 2025. China’s current capabilities in optical chips are on par with global standards, unaffected by the constraints of advanced integrated circuit processes, making it feasible for China to lead and innovate in this sector.

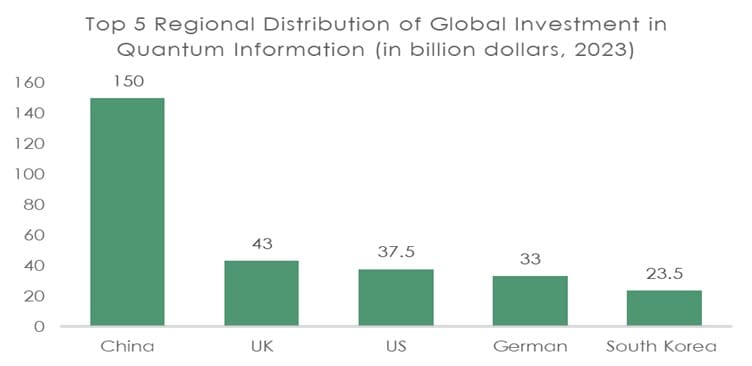

3. Quantum computing: The Chinese government has significantly increased support for quantum computing research, with R&D funding surpassing 10 billion yuan in 2024 and the successful development of the world’s largest third-generation superconducting quantum computer. By 2025, domestic quantum companies are expected to enter a more active development phase, rolling out hardware, software products, and quantum computing cloud platforms, with clearer commercialization models emerging.

Figure 3: Top five countries in global quantum information investment.

Source: Qianzhan Industry Research Institute

Source: Qianzhan Industry Research Institute

4. Low-altitude economy: As a strategic emerging industry, the low-altitude economy is rapidly growing, fuelled by policy support and investment. By 2025, the market size for China’s low-altitude economy is expected to reach 1.5 trillion yuan. Drones, low-altitude intelligent networks, and electric vertical take-off and landing (eVTOL) vehicles are becoming key growth drivers, accelerating industrialization. 2025 will be a pivotal year for infrastructure development, including low-altitude take-off and landing facilities, communication networks, and intelligent low-altitude systems, solidifying the foundation for the sector’s future growth.

Source link