How To Protect Yourself And Benefit

I’m a late adopter, which is why I haven’t thought too much about artificial intelligence (AI). I’d rather have early adopters figure out all the kinks first so I can better spend my time using the technology.

However, at a kid’s birthday party one Saturday, a dad, who works in finance, came up to me and asked how my WSJ bestselling book was doing. I told him nonchalantly that it was doing fine. Then he asked me when my next book was coming out. I told him probably sometime next year.

He responded in astonishment, “I didn’t know you were writing a second book! I had no idea!”

I told him with a shrug, “I guess my publisher thought the first book did well enough to give me a second chance.”

Then he let out a zinger, “I’m sorry you’re writing the book. Aren’t you worried about AI?” Then he caught himself by saying out loud, “I don’t know why I said that.”

Normally, people will say “congratulations” or “tell me more.” Instead, he implied that I was wasting my time and that struggling writers will make even less money than we already do.

Hey, fair points. He encouraged me to think more strategically about he future, which will better protect my wealth and my family. And for this, I’m grateful.

Main Way To Prevent Artificial Intelligence From Hurting You

Given the conversation, we might as well discuss how to protect ourselves and benefit from artificial intelligence. It seems there’s a bit of worry mostly amongst knowledge workers that artificial intelligence will eventually take their jobs.

And if artificial intelligence does replace them, then there may be even fewer well-paying jobs left for our children. This will result in more anxiety for nonparents and parents alike.

Hence, the number one solution to prevent the AI revolution from destroying your livelihood is getting so rich you and your children no longer need jobs! That amount is likely $20+ million for a family of four.

One way I plan to get rich is to invest in private AI companies. To do so, I’ve invested $150,000 in Fundrise’s venture capital product so far, which has large exposure to artificial intelligence. This way, I’m hedged if AI does very well. The investment minimum is only $10, so practically anybody can invest in private AI copanies.

We probably have three-to-ten years until AI starts noticeably eliminating knowledge-worker jobs. As a result, we had better save and invest as much as possible now.

But telling you to accumulate generational wealth, or $10+ million, or even $20+ million, is not very helpful or feasible for most people. Instead, here are some more feasible strategies on how to benefit from artificial intelligence.

How To Benefit From Artificial Intelligence And Get Richer

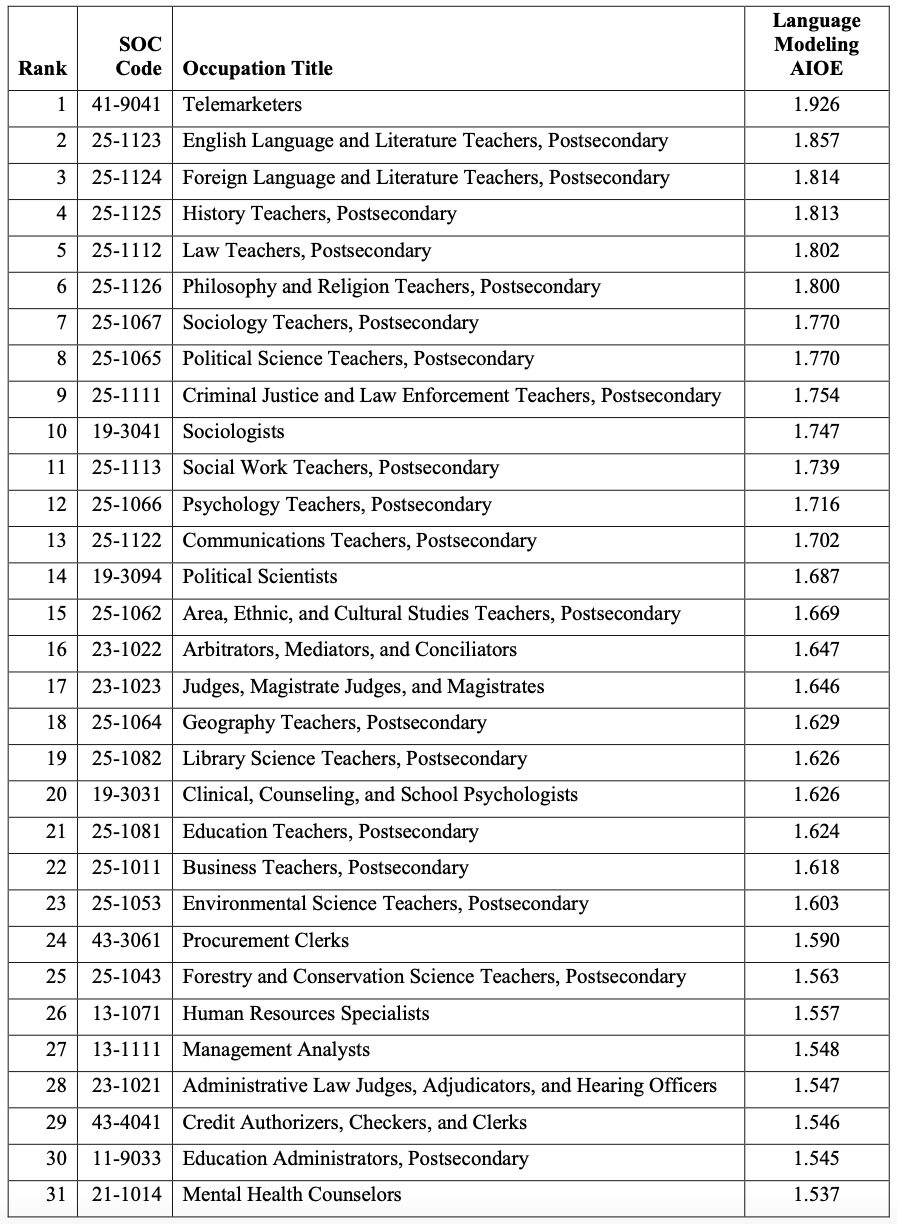

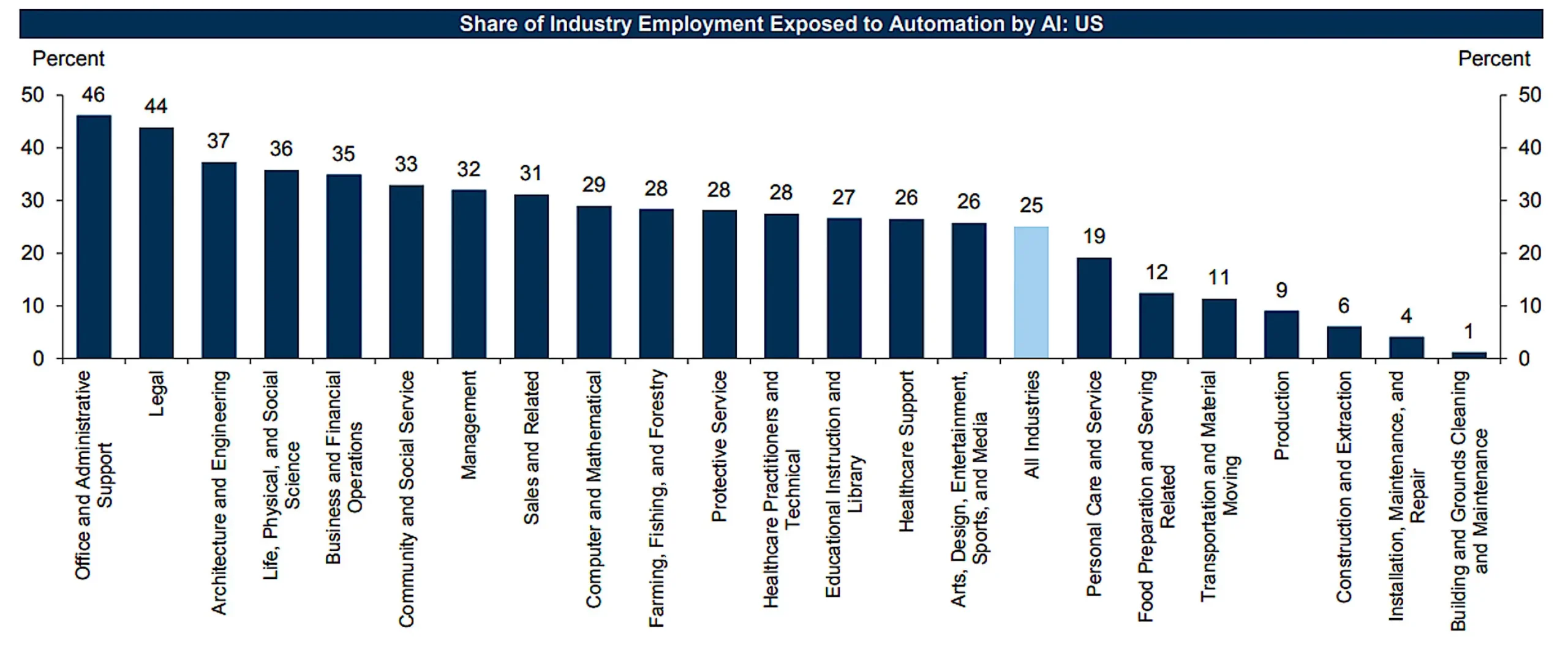

The first thing we need to do is understand which jobs are most at risk and least at risk due to artificial intelligence. From professors Ed Felton (Princeton), Manav Raj (U Penn), and Robert Seamans (NYU), here’s a list of occupations sorted by language modeling exposure score.

Jobs Most At Risk Of Getting Eliminated Due To Artificial Intelligence

It’s sad to see that so many teaching jobs are most at risk. Learning online has definitely gotten easier over time thanks to technology and multimedia. However, I’ve found that the best teaching is done in person where the teacher can adapt to the student’s needs and teach nuances.

AI can act as a tutor and help teach fundamental math, reading, and writing. But I would think for higher levels, a human teacher would be more effective. But maybe not!

If you plan to spend big bucks going to college, please major in something that leads to an occupation not at risk from AI. Even better is to study topics that can help you leverage AI. It feels like a liberal arts degree may be more at risk than a STEM degree. Although, people with liberal arts degrees may have more flexibility with their occupational choices.

I can see how proofreaders and copy editing jobs (#54) are most at risk due to AI. Personally, I’m excited to plop a draft of my post into an AI editing tool that fixes all my typos and grammar mistakes. This will save my dad and my wife 0.5-1.5 hours of time every time I write a post.

It’s nice to see that author, writer, blogger, podcaster, or vlogger are not in the top 62 most at-risk occupations due to AI! However, my dad lost his job to AI after 10 years as my editor. It was a bitter sweet moment when I decided to no longer send him posts to edit in 2024. However, I’m hopefully freeing up his time will enable him to enjoy his retirement more!

But when is AI going to help investors consistently outperform the S&P 500?

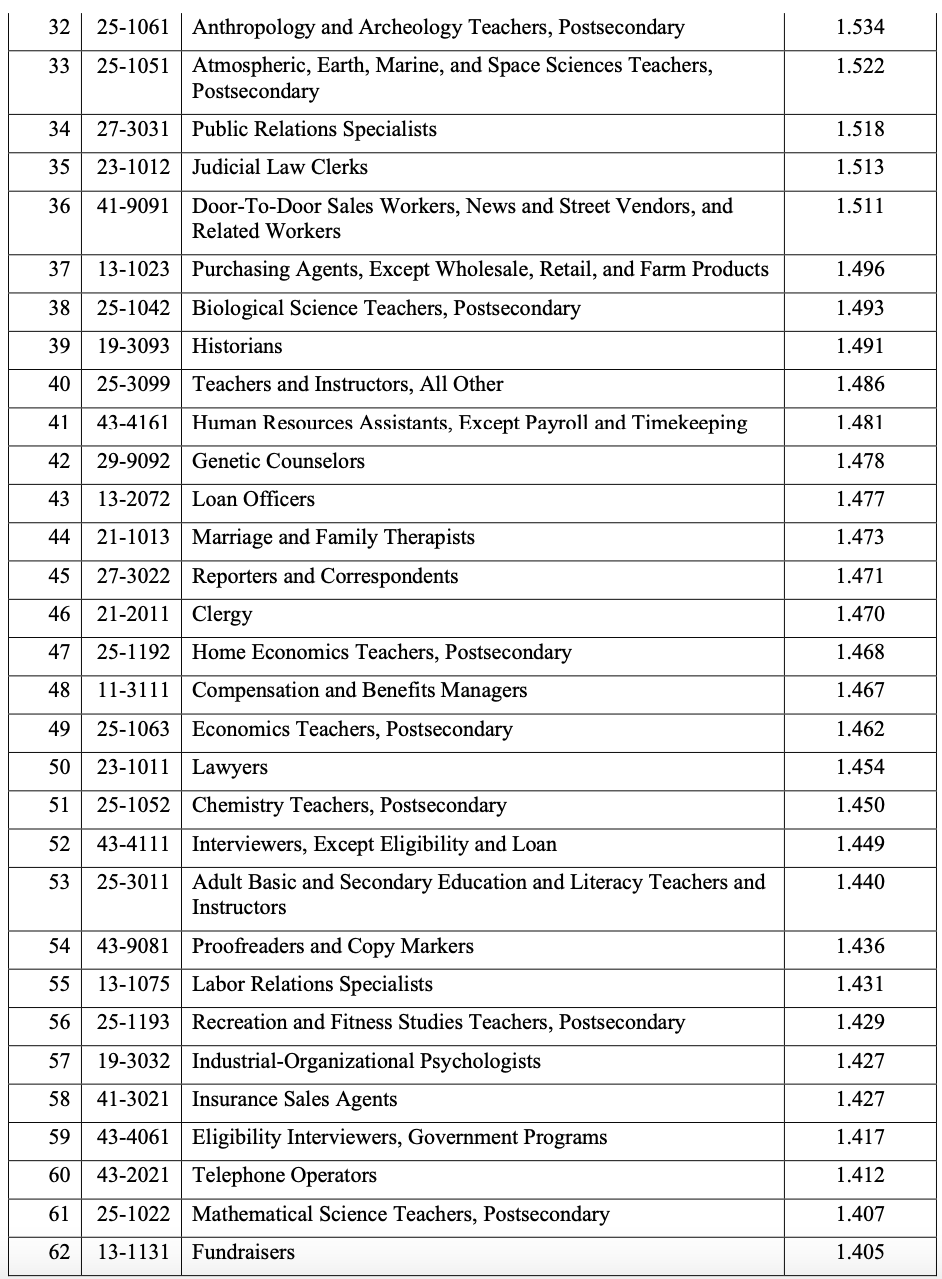

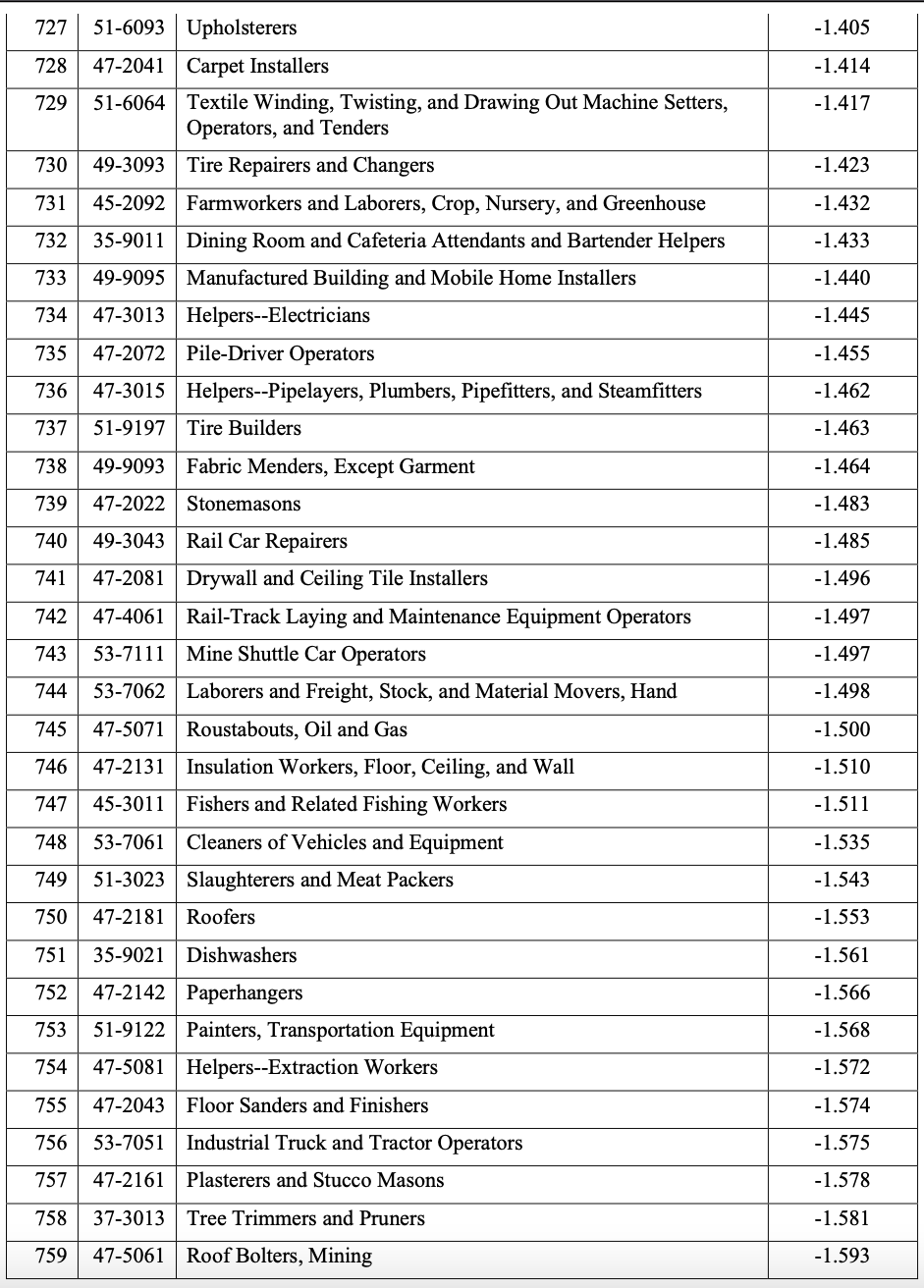

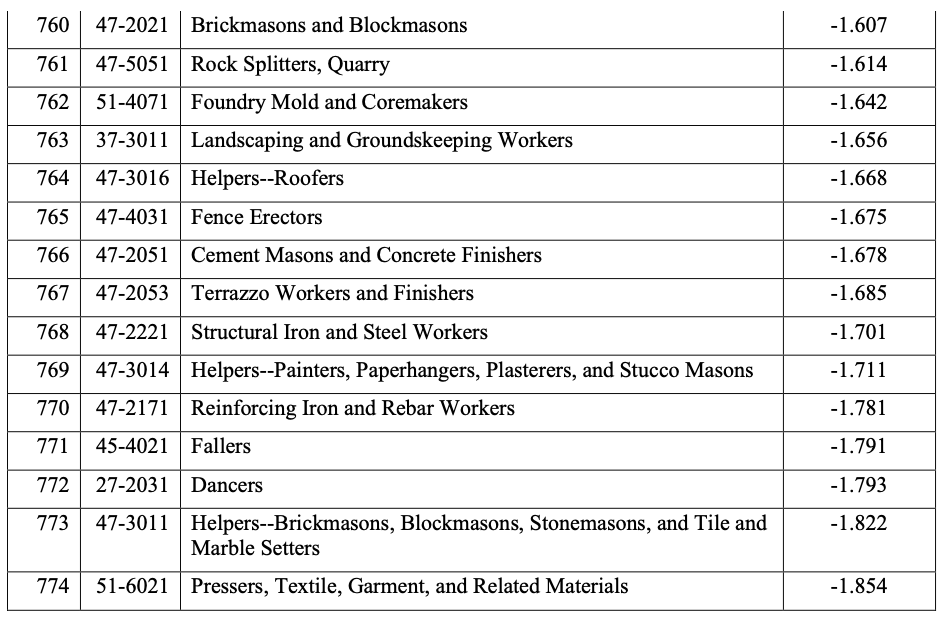

Jobs Least At Risk Of Getting Eliminated Due To Artificial Intelligence

To benefit from AI, you would simply look at the most at-risk occupations and utilize AI to enrich yourself or your business in these fields.

For example, you could use AI to teach you English, law, philosophy, chemistry, history, biology, anthropology, archaeology, communications, and business. Then you can utilize AI to do your PR, marketing, and fundraisers for your business. Finally, when you’re all frazzled, you can use AI to be your mental health counselor.

On the flip side, below are the jobs least at risk due to AI. Any jobs that requires building, customization, or service are relatively safe. You can’t have AI come to your house and replace your carpet. But you can have AI draw a layout and come up with different floor designs.

To see the entire 774 occupation list, download the report, Occupational Heterogeneity in Exposure to Generative AI.

Acquire The Necessary Skills To Work At Jobs Impervious To AI

Now that we know which occupations are the most and least at risk of getting eliminated due to AI, we can rationally acquire skills that will enable us to do jobs more impervious to AI. However, many of these “impervious jobs” are labor-intensive and not scalable.

To make more money off AI, one possible solution is to become a business owner of jobs that are relatively more impervious to AI.

For example, instead of me teaching tennis and getting paid by the hour, I could own a tennis academy that employs tennis teachers. I would provide the infrastructure and do all the marketing, branding, and customer acquisition. In turn, I would earn a percentage of each tennis teacher’s hourly earnings, e.g. $30 out of $120.

AI cannot teach someone tennis well. You can watch all the YouTube videos you want and you will unlikely become a great athlete or musician without in-person training. However, business owners can use AI to help with marketing, branding, course planning, and customer acquisition.

In general, it is much easier for an entrepreneur to utilize AI for the business’ benefit rather than for the employee. Business owners have so many tasks that can be automated or helped by AI.

Invest In Companies Leading The AI Revolution

If you can’t beat AI, you can join AI by investing in companies that will benefit from AI. The easiest way to do so is to identify publicly-listed companies and invest in a basket of them.

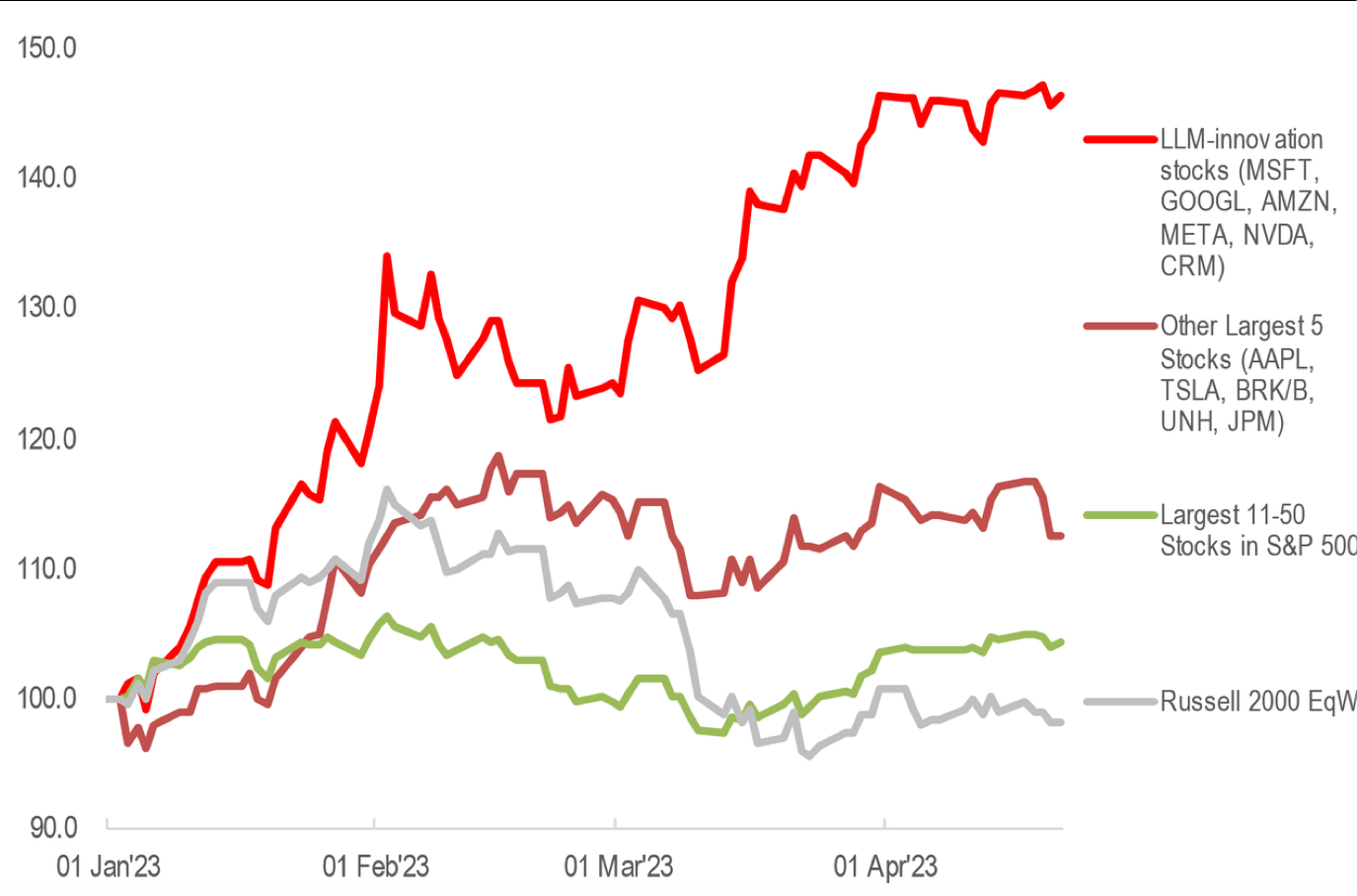

An analysis by JP Morgan found that interest in artificial intelligence, driven by ChatGPT and other large language models (LLM), has driven more than half the gains in the S&P 500 in 2023. And in 2024, artificial intelligence continues to drive the majority of gains in the S&P 500 and the NASDAQ.

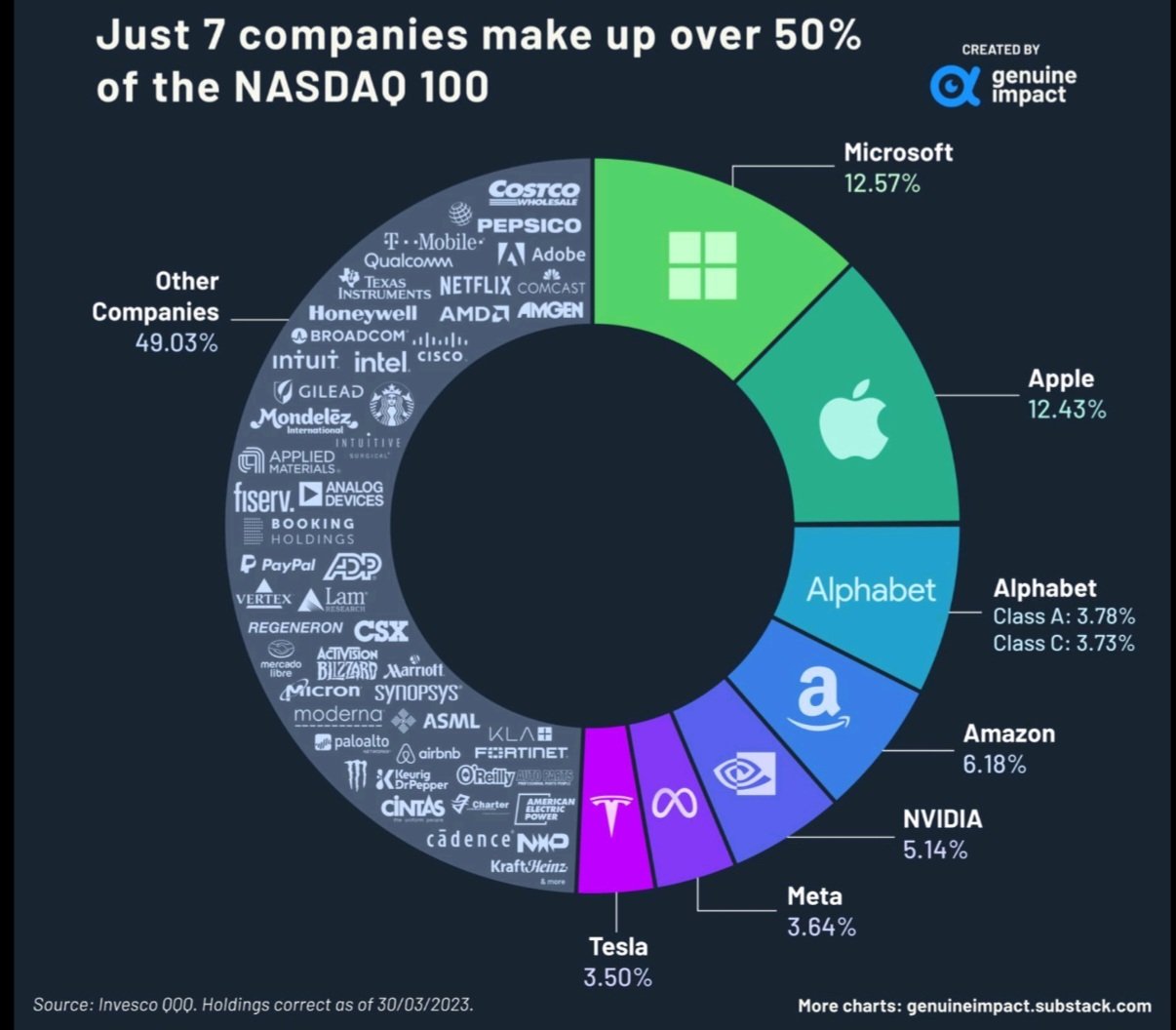

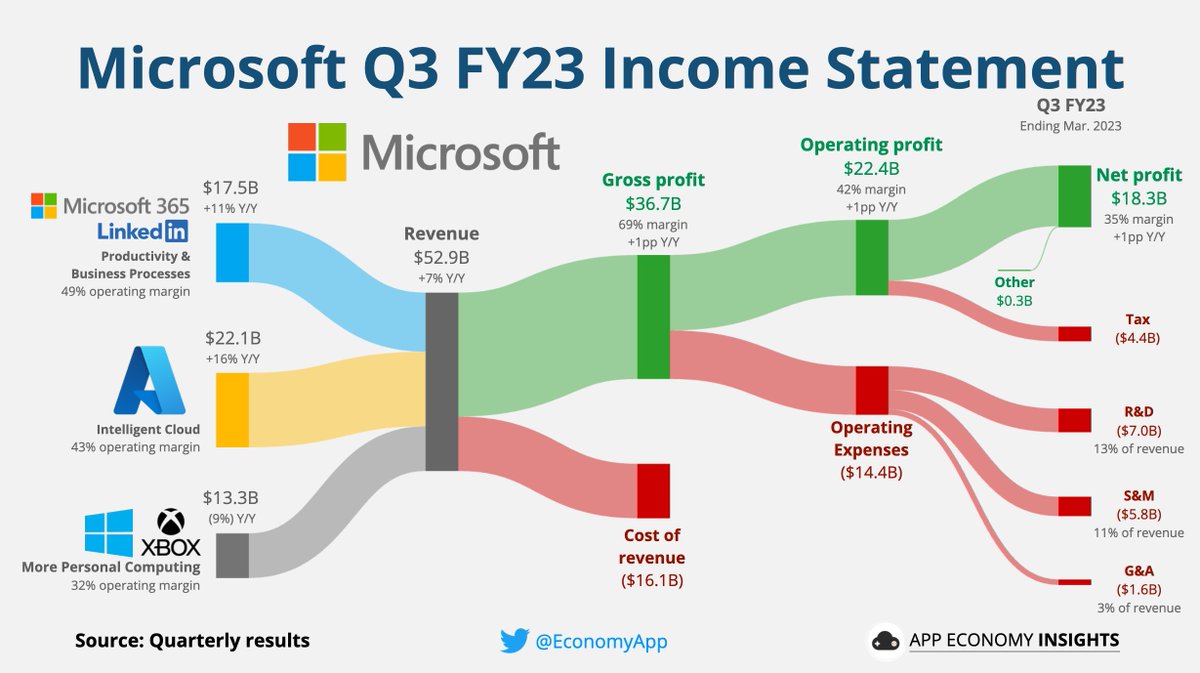

These artificial intelligence companies include Microsoft, Google, Amazon, Meta, Nvidia, and Salesforce. These companies also have some of the largest market caps and the largest balance sheets. Therefore, you can easily purchase stock in these companies. I personally own all the above names except for Salesforce.

You know Google isn’t going to sit idly and let Microsoft dominate the AI search landscape. But it is unclear how much AI will account for Google’s operating profits given the company is so large.

Given it’s hard to tell who the winners of AI are, you can also buy the entire NASDAQ index through an ETF or index fund. This way, you’re assured to have some higher beta AI exposure rather than just owning the S&P 500, which consists of only some of these large-cap companies.

Personally, I’m investing in private AI companies before they go public, to diversify and potentially earn greater upside. The main way I’m doing so is through Fundrise, which has about 90% of its exposure to AI companies.

Invest In Private Companies In The AI Space

After owning publicly-traded stocks with AI exposure, the next step is to invest in private companies in the AI space. This is a much riskier strategy given most of us have no edge. I’m not a fan of angel investing in individual companies.

However, I am a fan of investing in private funds with plugged-in general partners. Yes, we have to pay a higher fee to participate. But I am glad to pay a fee to gain exposure to an industry in which I have no expertise.

The main strategy is to invest with the best venture capital firms in the world, e.g. Sequoia, Benchmark, Kleiner Perkins, Accel, Bessemer, Khosla, Menlo, Greylock, GGV Capital, Founders Fund, Lightspeed, Canaan, and others. Many of them are based in the San Francisco Bay Area.

Not only will you gain exposure to private AI companies, you’ll also gain exposure to companies operating in multiple sectors. To increase your chances of investing in winners, you’ll have to invest in as many fund vintages as possible.

For example, I thought I was going to benefit when Figma was sold to Adobe for $20 billion. However, the Kleiner Perkins fund I invested in had no Figma exposure. The fund vintage before did.

I’m certain all the top venture capitalists are looking at as many AI startups as possible to invest in.

Invest In Real Estate Exposed To AI-Related Companies

After investing in public and private companies exposed to artificial intelligence, the next way to benefit from AI is to invest in real estate. Not any real estate, but real estate in cities where the largest AI-related companies are based.

Some of the largest companies in the world with AI exposure are:

- Amazon

- Apple

- Microsoft – (owns and controls OpenAI worth ~$86 billion)

- Meta

- Tencent

- Intel

- Alphabet

- Tesla

- Nvidia

- Oracle

- Cisco

- IBM

- AMD

- Micron

- Baidu

- Rockwell Automation

- SAP SE

Cities With The Largest Artificial Intelligence Exposure

Based on the list of companies above, you’d want to invest in real estate in:

- Seattle, Washington

- San Francisco, California – I decided to buy a new forever home in 4Q 2023 as I expect AI to drive San Francisco real estate prices higher

- Santa Clara, California

- San Jose, California

- Cupertino, California

- Palo Alto, California

- Menlo Park, California

- Burlingame, California

- San Mateo, California

- Beijing, China

- Shenzhen, China

- Austin, Texas

- Milwaukee, Wisconsin

- Armonk, New York and the New York City region

- Walldorf, Germany

All these cities, even without AI, are already quite attractive. But AI could juice their real estate returns even further. If you don’t live in these cities, then you can invest in private real estate funds that do invest in these cities.

As demand for artificial intelligence grows, more jobs will be created at these companies. More jobs will lead to more demand for housing, thereby pushing up rents and home prices at a faster rate than average. I experienced this firsthand as a landlord when Google, Facebook, Uber, Airbnb, Pinterest, and many more companies went public.

As these cities gain greater concentrations of AI talent, more employees will end up starting their own AI-related companies. As a result, there will likely be even more company success stories in terms of acquisitions or IPOs.

A positive flywheel effect ends up creating more wealth and innovation, attracting even more people to these cities. People go where there is the most opportunity!

Buying And Holding San Francisco Real Estate

The people who got rich during the 1849 California Gold Rush were mostly those who sold picks, shovels, wheelbarrows, and jeans. In contrast, most of the 300,000 miners went home with nothing after betting everything.

When I arrived in San Francisco in 2001 for my banking job, I marveled at the growth of the tech and internet sectors. After all, I worked at a firm that helped take many of these companies public.

However, because I was in the wrong industry, to increase my participation rate, the only things I could do were to buy tech stocks and own as much San Francisco real estate as I could afford. Making the techies work for me as a shareholder felt great.

The people who’ve gotten rich off internet and technology have now lived in the Bay Area for decades. They’ve grown roots, built networks, and raised children. As a result, I expect a continued outsized attraction of capital and talent with regard to AI in the San Francisco Bay Area.

I’m bullish on San Francisco Bay Area real estate long-term as I expect it to be one of the greatest beneficiaries of the AI boom. Although work from home is more widely accepted, the greatest developments come from in-person collaboration.

As a result, I’m buying single-family homes on the west side of San Francisco in neighborhoods such as Golden Gate Heights, Forest Hills, West Portal, Parkside, and St. Francis Wood. Buying San Francisco property in 2025 is a good move as many AI companies will go public or get acquired, showering the real estate sector with tremendous liquidity.

Artificial Intelligence Is A Long-Term Trend Worth Betting On

If you want to get rich, you must identify and invest in long-term trends.

You will inevitably lose some money along the way. There will also be times when your investments skyrocket to the moon, but you won’t cash out at the right time. However, with the proper net asset allocation, your returns could outperform over time.

Artificial intelligence is surely a long-term trend that will change the world and enrich many. It may be too late for old folks like me to gain skills to work at hot AI companies. Landing a job at AI companies may be too competitive for most folks as well. However, we can still all benefit from the AI revolution by strategically investing our capital.

Our children can also be more strategic in what they plan to study and do for a living. The last thing we want to happen is for our kids to spend four years in college only to find out their desired jobs are no longer necessary.

If AI is really going to eliminate teaching jobs in the future, then more colleges are facing an existential crisis. Perhaps in the near future, the cost of college will finally come down. Or maybe getting a college degree will only take two years instead of four plus years.

Make Sure You Build A Brand

Finally, we can leverage tools such as ChatGPT to make our lives easier. In fact, ChatGPT wrote this entire post! I’m kidding.

When artificial intelligence is finally able to write all my posts in the standard I want, it’ll be great! I’ll just spend more time traveling and playing tennis because I’ve built up a strong brand in the personal finance space.

I’ve had thoughts before about who will take over my writing and podcasting once my wife and I are gone. Maybe our children, maybe not. Hopefully, when the time comes for us to go, AI will be so great that Financial Samurai will live on forever!

Investing In Private Funds That Invest In AI

Personally, I’m investing in private funds like the one offered by Fundrise and several closed-end venture capital funds that are actively investing in AI companies. The Kleiner funds are through connections and invite only with a $200,000 investment minimum. But the Fundrise venture product is open to anybody and has only a $10 minimum.

Not only am I investing about $500,000 into various funds that invest in AI, I plan to also look for AI jobs in San Francisco. All the big ones, like Anthropic and OpenAI are based here. And then there are dozens of other AI companies looking to hire as well.

And if I fail to get a job in AI, at least I will have the rejection letters showing my kids that I tried! But hopefully, even with the rejections, what will happen is my $500,000 investment will 10X so that my kids are hedged.

Here’s my conversation with Ben Miller, founder and CEO of Fundrise, about artificial intelligence and their venture product for all to invest.

And here’s a follow up conversation I had with Ben Miller about investing in artificial intelligence. I think everyone should have some exposure to AI companies, either public or private. I’m doing both with up to 20% of my investable capital.

To invest in artificial intelligence, click here. I’ve invested $150,000 in Fundrise Venture so far, with more to come with each month of cash flow I generate. Fundrise is also a long-time sponsor of Financial Samurai as our investment philosophies are highly aligned.

Source link