I Followed These 3 Dave Ramsey Rules To Get Rich

It’s not unusual to hear about someone building wealth based on advice from a well-known financial expert. Many investors have experienced success in the stock market when they have listened to Warren Buffett’s pearls of wisdom, and homeowners have found themselves quickly building equity by following Barbara Corcoran’s real estate tips.

Check Out: 3 Signs You’ve ‘Made It’ Financially, According to Financial Influencer Genesis Hinckley

For You: 4 Affordable Car Brands You Won’t Regret Buying in 2025

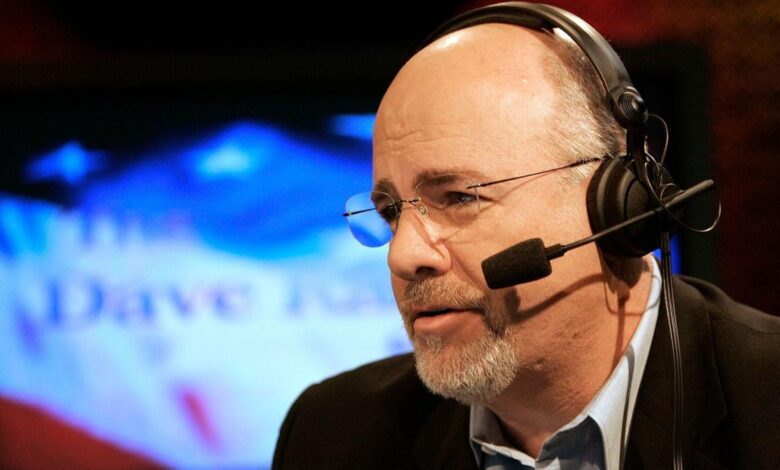

What about a financial expert like Dave Ramsey? Over the years, Ramsey has shared a lot of thoughtful money advice with listeners of “The Ramsey Show” and readers of his website, Ramsey Solutions. One of his signatures is the “7 Baby Steps,” a money management plan that empowers everyday Americans to take control of their finances.

Ramsey’s ‘Baby Steps’ has even enabled some Americans to reach millionaire status. GOBankingRates spoke to two self-made millionaires who each shared the Ramsey rules that made them rich.

Emergency funds are mentioned a few times in Ramsey’s Seven Baby Steps. The first step is saving $1,000 for a starter emergency fund. In Step 3, individuals are encouraged to save three to six months’ expenses once all debt has been paid off.

Self-made millionaire Jeff Mains is the founder of Champion Leadership Group. When Mains reflects on his journey as a business owner, he said Ramsey’s financial principles have been a guiding light in helping make early personal and professional business decisions.

An emergency fund, particularly a fully funded one, is a cornerstone for Mains’ financial strategies in his personal life and business. He told GOBankingRates that this fund acts as a safety net. He can take calculated risks necessary for business growth without worrying these risks could jeopardize the company’s financial health.

Scott Lieberman, self-made millionaire and founder of Touchdown Money, agrees with Mains about the third Baby Step positively impacting his financial health. Not only does a fully funded emergency fund provide Lieberman with peace of mind, but it also helps him actively grow his wealth.

“I have more than six months’ worth of savings in high-yield savings accounts,” said Lieberman. “I can access the money at any time. But while the money sits there, it’s earning interest.”

Read Next: 4 Secrets of the Truly Wealthy, According To Dave Ramsey

The second Baby Step encourages individuals to pay off all debt except their homes.

When possible, Ramsey recommends using the debt snowball method to do it. Individuals start by paying off debt with the smallest balance first and then “snowball” their way up to the debt with the highest balance. From a psychological standpoint, debt snowball delivers quick wins that build confidence toward paying off debt in full.

Source link