Motif Investing Investment Portfolio Review 1Q2015

On January 30, 2015, I finally opened up my first Motif Investing portfolio with $10,000. I waited until the end of January because I felt there was a lot of uncertainty in the market (there still is), and I was also taking my sweet time doing research on the 30 companies and ETFs I wanted to purchase.

Goals For Investing

1) To fully experience the Motif Investing interface to know about the good and the bad as an investor and as a consultant to make suggestions for further improvement.

2) To deploy $10,000 worth of cash that was just sitting in my bank account in order to make more than a lousy 0.1% interest. I’ve made it a habit of investing some amount of money in the stock market through my SEP IRA, 401k, Solo 401k, private wealth management account, or online brokerage account every month for over 10 years. I suggest doing the same as you’ll be surprised how quickly your balances add up!

3) To finally build a legitimate portfolio in an after-tax brokerage account, instead of just speculating on one to three stocks at a time. The portfolio is a comprehensive growth-oriented, special situations portfolio which is supposed to be diversified enough where rebalancing more than once a quarter is NOT necessary. I’m no longer actively looking for home run stocks because I’ve already built my financial nut. Instead, I’m looking for moderate growth in the 7%-12% range for my overall portfolio.

4) To follow the financial markets more carefully. From 1999 – 2012, I spent 5 – 10 hours a day reading investment research, watching financial news, reading financial news, following global politics, monitoring economic indicators, dialing into conference calls, and speaking about companies with clients. Then I’d start going for days without checking anything at all because I was so focused on building my online business. Having an active investment portfolio helps keep my mind sharp so I can make more intelligent investments, and be more knowledgeable when talking to others in the industry.

5) To create a community based investment portfolio. Back in 2010, I actually created a fictitious fund called The Samurai Fund made up by stocks picks from the community. It was fantastic fun that blew away the S&P 500 index thanks to crowdsourcing. For example, my pick was ticker symbol SAM of course, the Boston Beer Company that produces Samuel Adams beer. I bought the stock at $46.60, when the market cap was at $668. The share price is now at a whopping $272 with a market cap of $3.54 billion for a return of 483%!

There are plenty of investment enthusiasts reading Financial Samurai, and I’d love to engage all of your thoughts about the markets, the current positions in the motif, and what trades should be made, if any. Perhaps we can all become better investors and make more money if we put our heads together because it’s hard to keep track of everything, all the time. We can essentially create an investment club with ongoing discussion in the comments section of these quarterly posts.

FINANCIAL SAMURAI MOTIF PERFORMANCE REVIEW

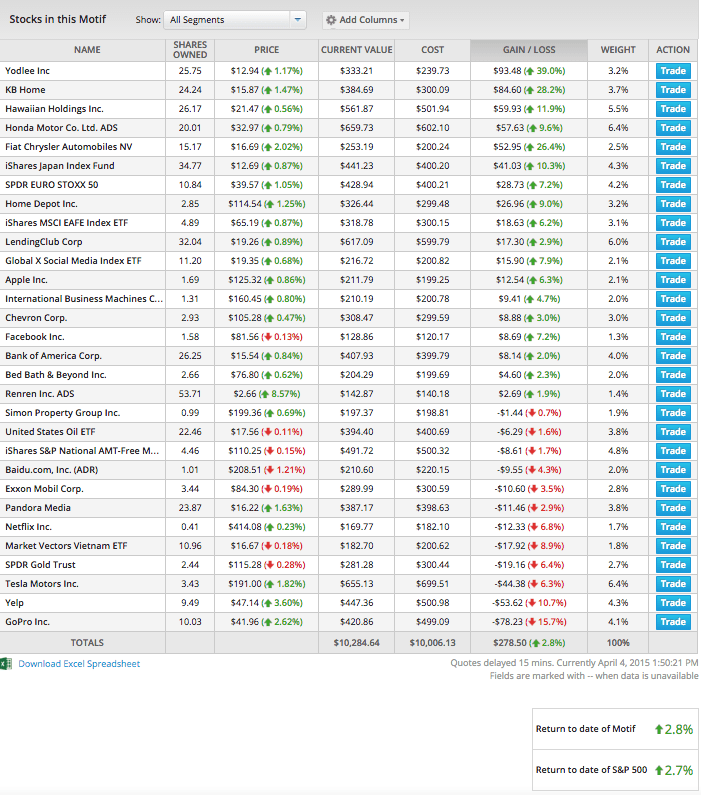

I’ve decided to sort my Motif portfolio by performance to make it easier to review. My Motif is actually diversified into six different categories: International/Alternative (21% weighting), Internet (20%), Autos (15%), Energy (15%), Residential Construction (11%), Financials (10%), and Tech (8%).

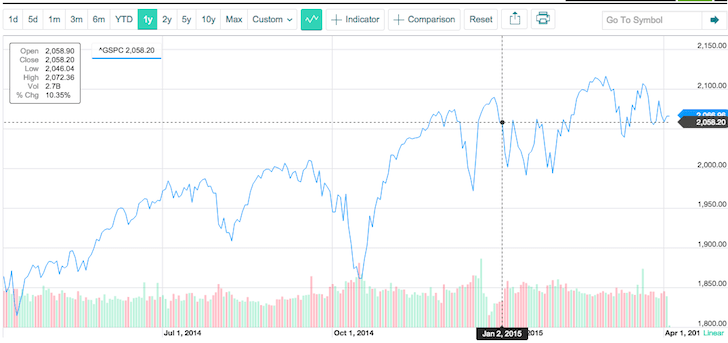

As you can tell, my Motif is outperforming the S&P 500 since the January 30, 2015 inception by an uninspiring 10 basis points. Everybody knows that outperforming the S&P 500 index over the long run is hard to do. I’ll take the mini-outperformance, as February and March were extremely volatile months where a lot of funds lost money.

But here’s the thing. The S&P 500 started the year off at 2,058 and closed on Friday, April 3 at 2067 for a 0.4% year-to-April 3 performance. In other words, my Motif is outperforming the S&P 500 by 2.4% so far. Whether that’s sustainable is to be determined in this extremely volatile market.

WINNERS AND LOSERS OVERVIEW

When you build an investment portfolio, you’ve got to think about your sector weightings, individual stock weightings, and your overall thesis. You don’t have to be right all the time. You just have to be right 51% of the time with assets that also make up at least 50% of your portfolio. The above motif has 18 positions in the green, and 12 positions in the red. Furthermore, you should be able to provide a reason why you are long or short a position. Here are some thoughts on some winners and losers.

Winners

* Yodlee (YDLE, $380M market cap, $-0.55 EPS): Yodlee is my biggest gainer up 39%. Who would have thought a small-cap, Bay Area tech and applications platform company would do so well? I bought Yodlee because I’m bullish on financial technology as someone who has been consulting at financial technology companies for 1.5 years (invest what you know theme). Yodlee is instrumental in allowing aggregation of financial accounts for companies like Venmo, Credit Karma, Mint, Personal Capital, and many more. After reporting results that disappointed analysts for the first time, the stock dropped about 30%. I made a bet that expectations would reset and Yodlee would make some changes. So far, so good as Yodlee is growing strongly in Australia/NZ, and announced an a business cash flow with forecasting finapp. I just fear that a ~40% return so quickly is too much, and expect a retrenchment. Fingers crossed for their next quarterly results!

* KB Homes (KBH, $1.46B market cap, $9.04 EPS, 1.76X P/E, +28.2%): I’m bullish on homebuilders and the property market, partly because I believe interest rates will stay low for longer while the economy continues to build up steam. The 2008-2010 financial crisis left a tremendous undersupply of new housing, and I think there will be a boomerang effect where people “catch up” to buy homes, remodel, and furnish. Furthermore, I believe funny money from the stock market will continue to flow to real estate. A lot of lessons were learned during the dotcom bubble of 2000. KBH is dirt cheap with earnings upside. I’m also long Home Depot (HD, +9%) and Bed, Bath & Beyond (BBY, +2.3%).

* Hawaiian Holdings (HA, $1.17B market cap, $1.10 EPS, 19.5X P/E, +11.9%): Call me biased as someone from Honolulu, but I believe Hawaiian Airlines is hands down the best airline in America. The service is impeccable and their timeliness is superb. 1Q is usually a seasonally weak period and the stock did well. With fuel cost savings, meaningfully lower capex in 2015, and seasonally strong periods coming up, I remain long. I suspect Hawaiian Airlines to expand new routes into Asia to meet the demand coming out of China. The Chinese will end up buying everything in the US, so you better buy something they like before their capital account really opens up.

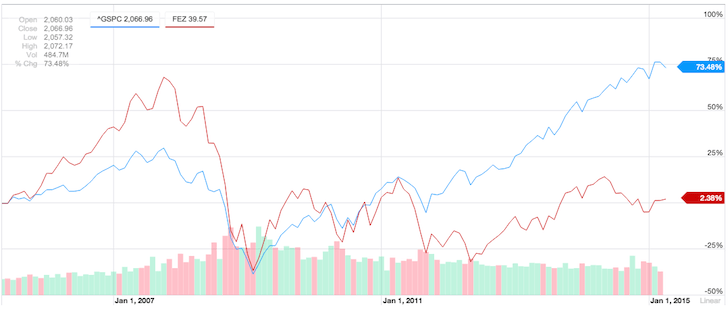

* Eurostoxx 50 Index (FEZ, +7.2%): When I see Europe, I see disaster and opportunity. I’ve taken two, two week long trips to Europe over the past three years and I feel hope. Take a look at the chart below. The correlation between the S&P 500 and the Eurostoxx 50 was tight for years until about 4Q2011. Then the S&P 500 (blue line) started pulling away. Now the performance gap is the widest it has been in 10 years thanks to the debt situation in Europe, which we ultimately solved in the US. I see a reversion to the mean with Europe catching up, and the US slowing down. I’ve also plowed six figures into a EuroStoxx 50 structured note as well.

* Honda Motor Corp (HMC, $59.5B market cap, $2.75 EPS, 11.98X P/E, +9.6%): With the purchase of my Honda Fit 2015, spending some time researching HMC was a logical next step. The company was going through capacity constraints after the nuclear accident in Fukushima in 2014. One couldn’t buy many 2014 models in the United States, even if they wanted to. I tried buying an older Fit myself by going to the dealer on three separate occasions in 2014 with no luck. But capacity constraints are only temporary. HMC built a factory in Mexico for their Honda Fit, and Honda will coming out with a stunning new design for its ever-popular Civic this fall. The stock is inexpensive, and I think they’ve got a fantastic new product cycle over the next couple of years. Oh yeah, how about Fiat (FCAU, +26%!)? March’s seasonally adjusted annual rate of sales number (car sales) of 17.15 million came in ahead of February’s number of 16.23 million and ahead of consensus expectations of 16.9 million. People are wasting money on cars again!

Losers

* GoPro (GPRO, $5.4B market cap, $0.92 EPS, 45.5X P/E): After reaching a euphoric high of $98.47 post $24 IPO price, GoPro has done nothing but go down, down, down. I thought I’d speculate and pick some up at $49, and I’ve consequently lost another 15.7%. If you are an avid outdoor sports person like I am (snowboarding, water sports), you see GoPro’s product everywhere. But, the competition is fierce and the stock is expensive. There’s strong competition coming from Xiaomi, which announced a 16-megapixel point-of-view camera last month, and Apple, which obtained a patent for a camera similar to GoPro’s offerings. Furthermore, the COO resigned. I might have to cut my losses on this guy if they don’t come up with some new business partnerships or products.

* Yelp (YELP, $3.5B market cap, $0.48 EPS, 99X P/E): Yelp is growing, but it’s not growing as fast as analysts expected in their latest quarterly result. Growth stocks in general got crushed in 1Q2015, and Yelp was right in the thick of things. Yelp bought Eat24, a bootstrapped, food-delivery company for $100+ million to integrate with their review service. I think that’s smart long-term. They probably also got a good deal, as upstarts like DoorDash are getting majority funded by VCs right now at absurd valuations. Finally, there’s opportunity in another acquisition, SeatMe, which is their OpenTable alternative. I’m looking to buy more shares here instead of sell.

* Tesla Motors (TSLA, $24B market cap, $-2.36 EPS): Tesla is another high growth stock with high expectations and high valuations. They aren’t making money yet, and don’t plan to for the foreseeable future. Reports out of China show their sales have lagged expectations, and nobody knows what to expect about their lower-cost Model X sedan and SUV. Tesla is suffering from a lack of product innovation as the novelty of the Model S wears off. Furthermore, low oil prices may lower electric vehicle (EV) interest at the margin. But I’m betting that as soon as Elon starts talking up his new product line-up, enthusiasm for this stock will return as well. Right now, it’s just not great being long high-growth, expensive companies.

* Energy Sector: It’s interesting to see Chevron up +3%, while USO is down -1.6%, and Exxon Mobile is also -3.5% since I bought these stocks. You’d think Chevron and Exxon Mobile would be much more tightly correlated. The FS community brought up an interesting point about contango and USO, where the future spot price is below the current price, and people are willing to pay more for a commodity at some point in the future than the actual expected price of the commodity. This may be due to people’s desire to pay a premium to have the commodity in the future rather than paying the costs of storage and carrying the costs of buying the commodity today. I have no idea how long oil prices will remain depressed, but after a 50% decline in oil prices, I’m betting for upside movement rather than more downside. See: Should I Invest In Oil Stocks?

OVERALL TAKEAWAYS

Being up 2.8% for 1Q2015 is strong compared to a flattish S&P 500, especially since I created a 30 position portfolio, rather than choose a handful of stocks to gamble. The portfolio requires minimum trading, and provides for lots of restful nights. I checked my Motif account on average once every 10 days vs. multiple times, every day when I was trading single stocks with E*TRADE and Fidelity.

Despite being able to rebalance all 30 positions for only $9.95 ($4.95 for individual positions), I plan to make no changes to my portfolio for now unless the community can convince me otherwise. The outlook for the rest of the year is dicey given the Fed is expected to finally raise rates in 4Q2015. I’m all ears so please share your thesis on energy, housing, technology, Europe, and the overall market in the comments!

The average position size for a 30 investment portfolio is 3.33% and I’ve currently got weightings ranging from 1.3% to 6.5%. When weightings start hitting 1% and 7%, I’ll think about rebalancing if I still like the investments. I’m sure I will underperform the markets eventually as 2015 looks very dicey. When that day comes, I’ll be glad to discuss why so we can all learn to become better investors.

Managing your own investments can be a full-time job. That’s a problem if you are not retired, have other interests, or don’t manage money for a living. I spend most of my time writing about personal finance, consulting, and running an online media business nowadays. I no longer have time to actively invest like I once did for 13 years.

Wealth Building Recommendations

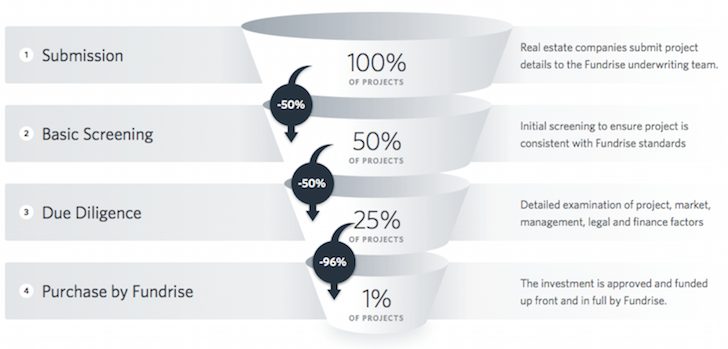

Explore real estate crowdsourcing opportunities: If you don’t have the downpayment to buy a property, don’t want to deal with the hassle of managing real estate, or don’t want to tie up your liquidity in physical real estate, take a look at Fundrise, one of the largest real estate crowdsourcing companies today.

Real estate is a key component of a diversified portfolio. Real estate crowdsourcing allows you to be more flexible in your real estate investments by investing beyond just where you live for the best returns possible. For example, cap rates are around 3% in San Francisco and New York City, but over 10% in the Midwest if you’re looking for strictly investing income returns. Sign up and take a look at all the residential and commercial investment opportunities around the country Fundrise has to offer. It’s free to look.

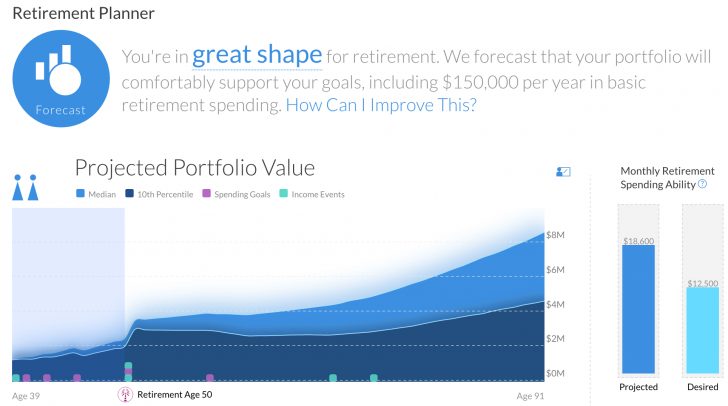

Stay On Top Of Your Money: Sign up for Personal Capital, the web’s #1 free wealth management tool to get a better handle on your finances. In addition to better money oversight, run your investments through their award-winning Investment Checkup tool to see exactly how much you are paying in fees. I was paying $1,700 a year in fees I had no idea I was paying. After you link all your accounts, use their Retirement Planning calculator that pulls your real data to give you as pure an estimation of your financial future as possible using Monte Carlo simulation algorithms.

Updated for 2019 and beyond.

Source link