The Average Net Worth For The Above Average Person

When it comes to your finances, everything is relative. To get ahead, you must outperform the average. If everybody is up 20% in their investments, have you really gotten richer? You have not. This post will discuss the average net worth for the above average person. Our goal is to outperform the average so we can live better lives.

You’ve got one life to live. You can have the average net worth in America, which is pretty low. Or, you can shoot to have an average net worth for the above average person. Let’s all shoot to be above average with our one and only lives! This is, after all, Financial Samurai, the top personal finance site in the world with over 1 million organic page views a month.

If we all earn $1 million dollars a year and have $5 million in the bank at the age of 40, none of us are very wealthy. With this level of wealth, all our living costs (housing, food, transportation, vacations) will be priced at levels that squeeze us to the very end.

As such, we must first get an idea of what the real average net worth is in our respective countries, and then figure out the average net worth for the above average person!

Suggestion: In addition to building wealth through stocks, also invest in real estate. Real estate provides the powerful one-two punch of principal appreciation and rental income growth over time. Fundrise manages over $3 billion in private real estate investments, mainly in the Sunbelt region where valuations are lower and yields tend to be higher. With the Fed embarking on a multi-year interest rate cut cycle, there should be increased demand in real estate in the coming years. I’ve personally invested over $300,000 with Fundrise so far.

Average Net Worth By Age In America

According to the latest Federal Reserve’s Triennial Consumer Finance Survey available, the average net worth for the following ages are:

Under 35: $76,200

35-44: $288,700

45-54: $727,500

55-64: $1,167,400

65-74: $1,066,000

75+: $1,067,000

Not bad. Believe it or not, the average household net worth in America is now $1.06 million. But these average net worth numbers are skewed by the super rich who have generated an enormous amount of wealth since the financial crisis. The median household net worth is closer to $192,000, which is a better reflection of America. And when most people think about average net worth, they are really thinking about the median net worth.

Now compare the average and median net worth in America to the median age for Americans at 36. Your goal is to try and beat the average net worth by age in America every step of the way.

I started Financial Samurai in 2009 and it is the top personal finance on the web today. I worked in investment banking at Goldman Sachs and Credit Suisse for 13 years, got my MBA from Berkeley, and write everything based off firsthand experience. In 2012, I retired at age 34 with a $3 million net worth, and have been publishing three times a week ever since.

If you’re looking to achieve financial freedom from someone who has, you’ve come to the right place. I firmly believe if you join 65,000+ others and subscribe to the free Financial Samurai newsletter, listen to the free Financial Samurai podcast on Apple or Spotify, and immerse yourself in personal finance by reading a great personal finance book, you will grow your net worth for above average.

Let’s look at the average net worth for above average people. It’s much more rewarding to shoot for stretch goals and achieve the.

The Above Average Person Is Loosely Defined As

1) Someone who went to college and believes grades and a good work ethic do matter. Or someone who graduated from high school and went straight to work in the trades or building your own business.

2) Does not irrationally spend more than they make.

3) Saves for the future because they realize at some point they no longer are willing or able to work.

4) Takes responsibility for their own actions when things go wrong and learns from the situation to make things better.

5) Takes action by leveraging free tools on the internet to track their net worth, minimize investment fees, manage their budget, and stay on top of their finances in general. Once you know where all your money is, it becomes much easier to optimize your wealth and make it grow.

6) Welcomes constructive criticism and is not overly sensitive from friends, loved ones, and strangers in order to keep improving. Keeping an open mind is critical.

7) Has a healthy amount of self-esteem to be able to lead change and believe in themselves.

8) Has a diversified net worth, which includes stocks, bonds, real estate, and alternative investments.

9) Enjoys empowering themselves through learning, whether it be through books, personal finance blogs, magazines, seminars, continuing education and so forth.

10) Has little-to-no student loan debt due to scholarships, part-time work, or help from their parents. Our parents have saved and invested through the largest bull market in history. It’s understandable that parents want to help their children out.

11) Does not confuse brains with a bull market.

12) Understand the power of inflation and believes $3 million is the new $1 million

13) Is constantly learning and reading about health, wealth, and relationships. In fact, the above average person reads 10X more than the average person.

Check out my Wall Street Journal bestseller for sale at bookstores everywhere and on Amazon, Buy This, Not That: How To Spend Your Way To Wealth And Freedom. It is the best personal finance book you can read today.

FinancialSamurai.com is an Amazon Associate. When you buy through links on our site, we may earn a commission at no additional cost to you. Thanks for your readership and support.

The Above Average Net Worth Deconstructed

Now that we have a rough definition of what “above average” means, we can take a look at the tables I’ve constructed.

The tables are based on the tens of thousands of past comments by you. They are also based on the more than 2,500 posts I’ve written since 2009 to highlight the average net worth of the above average person.

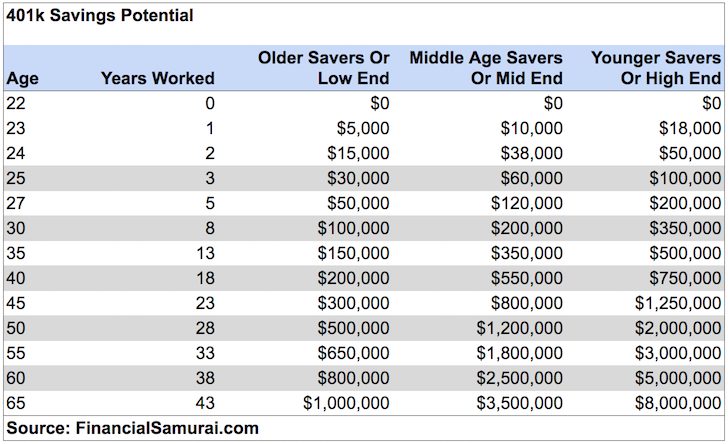

First, we’ll focus on the simple 401(k) retirement savings system. For 2024, one can contribute a maximum of $23,000 in pre-tax dollars. The maximum contribution amount will likely go up by roughly $500 every couple years if history is any guide.

This chart can be used as a rough estimate for those with the RRSP plan in Canada and retirement plans in Europe and Australia as well.

In fact, any country that has any sort of tax-deferred retirement plan and social safety net program for retirement that has a GDP/capita of $30,000 or more can use the below chart as an aspirational guide.

Remember, we are talking about the “above average person.” Given not everyone can contribute the maximum 401(k) amount, I’ve used an average contribution of $18,000 instead. In 2024, the maximum 401(k) contribution for an employee is $23,000.

Financial Samurai 401(k) Savings Guide

The average net worth for the above average person takes full advantage of his or her 401(k). The 401(k) is a tax-advantaged account where you contribute pre-tax dollars, which lowers your taxable income and tax bill. The money then compounds without a tax drag.

Only after 59.5, when you can start withdrawing from your 401(k) penalty-free, do you need to pay taxes on the withdrawals. However, by then, your marginal income tax rate should be lower since you’re retired.

Below is the recommended 401k amounts by age.

401(k) Contribution Assumptions

The assumption here is that the above average person is able to start maxing out their tax-deferred retirement plan every year after the second full year of work. He or she will continue on without fail until 65. You can read more about the right contribution order of your investments between tax-advantaged and taxable accounts.

The low and high end account for a conservative 0% return to a more historical 7% – 9% constant rate of return. Of course you can lose money if you are unlucky and make much more if you are good and lucky.

Given the 401(k) maximum contribution limits have increased over time, the left column can also be used as guidance for older savers over 45 years old. The middle column can be used for middle aged savers between 30 – 45. The right column can be used by younger savers under 30 who can max out at higher amounts for the majority of their careers.

For example, when I started contributing to my 401k in 1999, the maximum contribution limit was only $10,000. If you are a 40 year old, it’s best to focus on the Mid End column.

This chart does not take into consideration any after-tax savings post 401K contributions. However, the high end does include 401k company contributions, as this is common for those with seniority and those who work at profitable, generous companies.

For example, for my last five years at work, my employer paid out more than $20,000 a year in profit sharing.

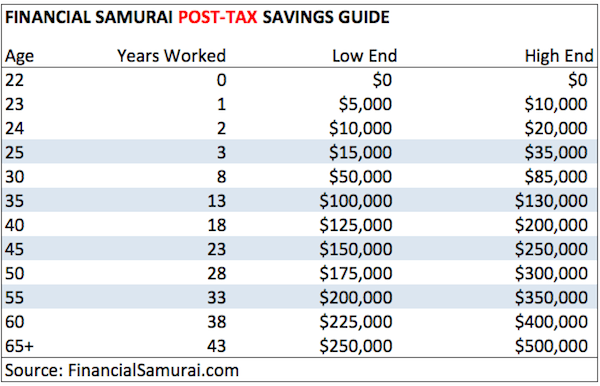

Financial Samurai Post-Tax Savings Guide (Taxable Investments)

The average net worth for the above average person is also bolstered by building a large taxable investment portfolio. After all, you can’t withdraw from your 401(k) before 59.5 without a 10% penalty. When I say post-tax, I mean taxable investment portfolios such as your online brokerage account.

It also refers to your rental property portfolio you are building. Some of you may simply prefer real estate over stocks. That’s fine. Real estate has historically been a fantastic wealth-creator long term. The combination of rising rents and rising property values is hard to beat.

My favorite private real estate investing platform is Fundrise, which focuses on residential and industrial properties in the Sunbelt region. Valuations are lower and rental yields are higher in the Sunbelt. The platform was founded in 2012 and manages about $3 billion in real estate.

The above chart assumes on the low end that one saves about $5,000 a year in after-tax income and around $10,000-$15,000 a year in after-tax income on the high-end after maxing out their tax-deferred retirement vehicle.

I’ve tried to keep things as simple as possible, assuming no inflation and no investment returns. I also believe saving $5,000-$15,000 a year in after-tax income is very realistic for the above average person, and probably very easy for many who earn more than $85,000 per person.

If you want to achieve financial independence sooner rather than later, it’s your accessible post-tax savings and investments that matters more than your tax-advantageous retirement accounts like your 401(k), IRA, Roth IRA, and so forth. Why? Because your post-tax savings guide is what will spit out passive income to pay for your lifestyle.

Finally, the chart should show you the power of consistency. Every person who wants to be above average financially should target a 20% savings rate after maxing out their 401(k) contribution.

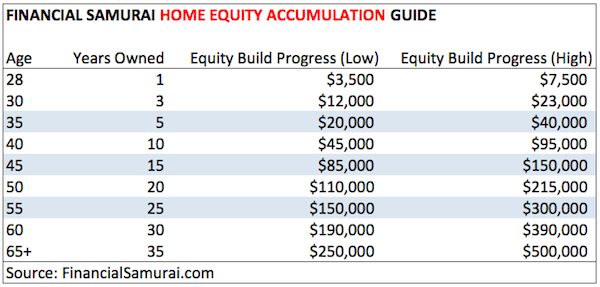

The Importance Of Real Estate To Build Wealth

The average net worth for the above average person also owns his or her primary residence and invests in real estate for income and diversification purposes. Inflation is too powerful a force to combat. If you are a renter, you are short inflation and the real estate market, which is no good long-term.

The Federal Reserve study showed that the average net worth of a homeowner is roughly $1,034,000. This is 11X greater than the average renter’s net worth of $91,000. Some studies show the average net worth for homeowners is 40X higher! This is a result of long-term acid price appreciation and forced savings.

We can debate the merits of this study all day long (demographic sampling, housing price changes, etc), but the point is: above average people generally all own homes and are much wealthier than renters.

The return on rent is always negative 100%. You get a place to live and that’s that. There is never a positive return on an asset after a month, or 30 years of renting. A renter cannot pass on her paid off house to her kids or grandchildren. There is no asset accumulation at all. There is a reason why some 97% of millionaires are property owners.

The value of real estate varies across all the land and the world. It is very hard to make an assumption of what should be inputted as a result. According to the US Census bureau, the median home price in America is roughly $440,000 as of 2024.

Real Estate Investing Arbitrage

You can’t get anything livable in San Francisco, New York City, Los Angeles, Washington DC and Boston for $440,000. But, you sure can in the Midwest where I’m aggressively investing money through real estate crowdfunding platforms like Fundrise. They provide a way for all investors to diversify into real estate through private funds with just $10.

Valuations are so much cheaper and the net rental yields are so much higher in non-coastal cities compared to the coastal cities. With companies like Google investing $13 billion in heartland real estate to expand operations, you know other companies and investors will follow.

Further, work from home is here to stay after the pandemic. Technology has made working from home acceptable.

As a result, there will be a multi-decade migration away from densely populated and more expensive cities to cheaper cities with more space. CrowdStreet specifically focuses on real estate opportunities in 18-hour cities like Charleston, South Carolina vs. 24-hour cities like Los Angeles, California. 18-hour cities are secondary cities with lower valuations and higher rental yields. These cities also have higher growth potential due to job growth and demographic trends.

I personally sold a San Francisco rental property for 30X annual gross rent and a 2.5% cap rate in 2017. Then, I reinvested $550,000 of the proceeds in real estate crowdfunding with a target 10% cap rate. It feels good to diversify into no-coastal city real estate and earn income passively.

My total investment is $954,000 in the space. I’ve received over $800,000 in distributions since 2017. It’s been great to diversify my expensive real estate holdings and earn more income passively.

Financial Samurai Home Equity Guide

Let’s now construct an equity value chart of something based on a range of $250,000-$500,000. Let’s assume that upon retirement, you have your house paid off and can attribute this amount into your net worth.

I assume that the above average person buys a $250,000-$500,000 piece of property at 27. By the time they turn 28, they will have owned the property for 1 year. They will have also paid down $3,500-$7,500 in principal on a $250,000-$400,000 loan.

I conservatively assume a $250,000 no money down loan for the low end house. Even though after 5 years of working, the low-end above average person should have around $25,000-$30,000 saved up in cash based on the after-tax savings charts above.

Paying Down Debt Is What Above Average People Do

By the time a 27 year old pays off his or her mortgage in 30 years, s/he will be 57 years old with a place to live rent from for the rest of his/her life. That is the true value of the property, the rent saved for the remainder of the owner’s life.

I assume zero price appreciation on the home. It’s always best to keep things conservative. There are no extra payments to accelerate the payoff either.

Home prices have historically returned just a bit above inflation every year e.g. 3-4%. But given the above average person puts down about 20%, the 3-4% returns suddenly turns into a 15%-20% cash-on-cash per year.

15-20% compares favorably to the average S&P 500 return of roughly 5.6% from 1999-2018 and 10% since 1926. Although, expect future returns for stocks, bonds, and real estate to be lower.

Add on the tax benefits for mortgage interest deduction and owning a home through a mortgage becomes very beneficial for higher income earners.

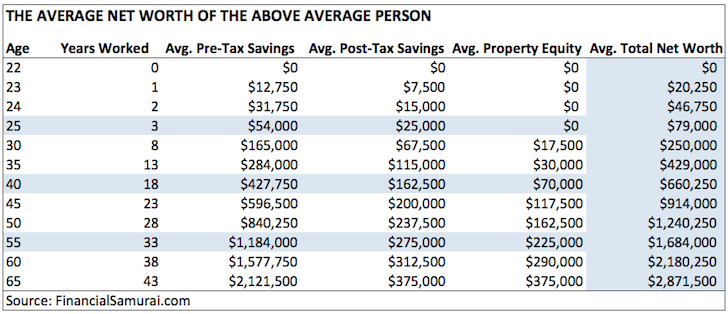

The Average Net Worth For The Above Average Person

Below is the end result. It shows the average net worth for the above average person by age and years of work experience.

The chart includes the average 401(k) amounts, average taxable investment amounts, and average real estate equity amounts. The table should give you a rough net worth amount to shoot for if you want to be considered above average.

The average net worth for the above average person by age is as follows:

$250,000 by 30

$429,000 by 35

$660,000 by 40

$914,000 by 45

$1,240,250 by 50

$1,684,000 by 55

$2,180,250 by 60

Somewhere in their mid-40s, the above average person becomes a millionaire. In comparison, the average American only becomes a millionaire between 55-64. This is 10-15 years later according to the Federal Reserve.

The key is to stay disciplined with your savings and investing routine. With a proper asset or net worth allocation, you’ll be amazed at how far your net worth will grow over time.

Stay On Top Of Your Finances

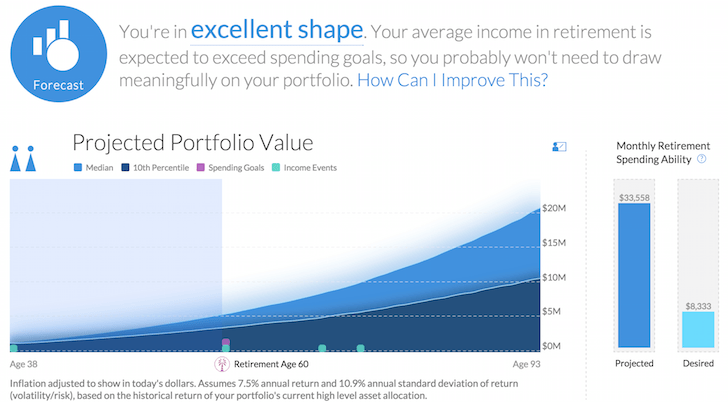

The best way to build wealth is to get a handle on your finances by signing up with Empower. They are a free online platform which aggregates all your financial accounts on their Dashboard. This way you can see where you can optimize your finances.

They’ve also come out with their incredible Retirement Planning Calculator. The calculator uses your linked accounts to run a Monte Carlo simulation to figure out your financial future.

The average net worth for the above average person is all over tracking his or her finances. There’s no rewind button in life. It’s better to end up with a little too much than a little too little.

Invest In Real Estate More Strategically

If you want to have an above average net worth, you should also consider investing in real estate. Real estate is a core asset class that has proven to build long-term wealth for Americans. Real estate is a tangible asset that provides utility and a steady stream of income if you own rental properties.

My favorite private real estate investment platform Fundrise. I believe real estate has bottomed and prices will rebound as the Fed starts cutting rates.

Fundrise has been around since 2012 and manages over $3 billion in assets under management and has nearly 400,000 investors. It’s investments predominantly focus on residential real estate in the Sunbelt, where valuations are lower and yields are higher.

I’ve personally invested $954,000 in real estate crowdfunding across 18 projects. My goal is to take advantage of lower valuations in the heartland of America. There is a strong demographic shift towards lower cost areas of the country. Technology and the rising trend of working from home will make this trend permanent.

Financial Samurai is a six-figure investor in Fundrise funds and Fundrise is a long-time sponsor of Financial Samurai.

Order My New Book: Millionaire Milestones

Finally, if you’re ready to build more wealth than 90% of the population, grab a copy of my new book, Millionaire Milestones: Simple Steps to Seven Figures. With over 30 years of experience working in, studying, and writing about finance, I’ve distilled everything I know into this practical guide to help you achieve financial success.

Here’s the truth: life gets better when you have money. Financial security gives you the freedom to live on your terms and the peace of mind that your children and loved ones are taken care of.

Millionaire Milestones is your roadmap to building the wealth you need to live the life you’ve always dreamed of. Order your copy on Amazon today or at any book retailer and take the first step toward the financial future you deserve!

Join 65,000+ others and subscribe to my free weekly newsletter. Since 2009, the newsletter has helped people achieve financial freedom sooner, rather than later. The Average Net Worth For The Above Average Person is a Financial Samurai original post.

Source link