Wealth transfer discussions are changing in an age of growing financial literacy

THIRTEEN years ago, Ken Wong and his wife bought a two-storey property to house their growing family. The purchase required borrowing close to their maximum loan amount from a bank, but the Wongs also factored in a likely inheritance from his parents.

“After some calculations, as well as consultations with my parents, we decided we could comfortably afford it,” said Wong, who is an only child.

Once upon a time, someone like Wong probably wouldn’t have dared broach such a topic with his parents. Attitudes towards wealth transfers and inheritance are changing, though.

A retirement sentiment survey conducted in Singapore found three in four respondents have started planning for retirement.

The study, conducted by market research group Kantar on behalf of The Business Times and Etiqa Insurance Singapore, surveyed more than 1,000 individuals.

Of those who have started planning for retirement, 12 per cent said that plan included the expected inheritance of legacy assets.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

Among those who had not started planning for retirement, 15 per cent said they were intending to rely on other sources of income – including their inheritance.

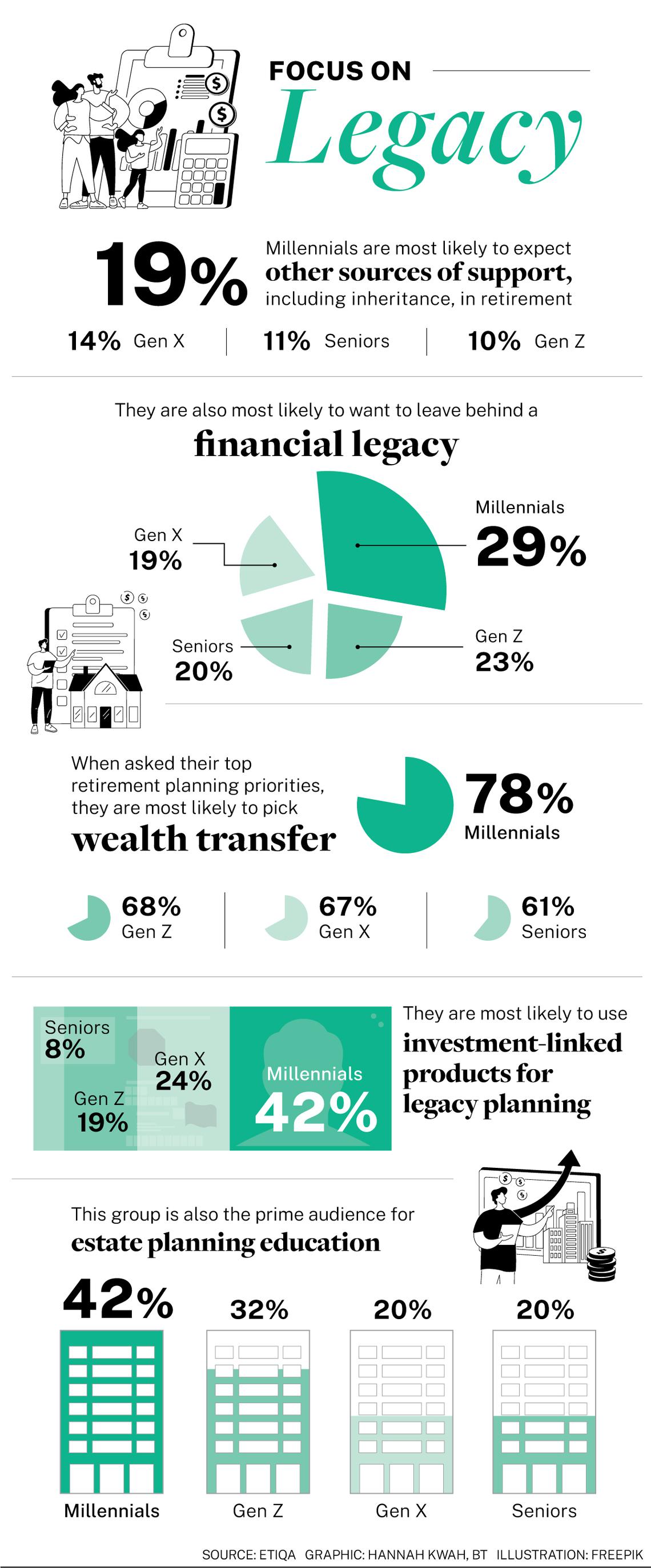

Millennials were most likely to expect an inheritance. Raymond Ong, chief executive of Etiqa Insurance Singapore, said this could be due to changing family dynamics.

“Millennials have typically grown up in smaller families, and may stand to inherit a larger sum of wealth from their baby boomer parents.”

Thanks to this demographic phenomenon, often referred to as the “great wealth transfer”, millennials will become the richest generation in history, he added.

Knowing that they stand to inherit something has not, however, stopped most millennials from planning for the future. In fact, this cohort is also the most likely to want to leave behind a financial legacy.

According to the survey, 29 per cent of millennials list this as one of the things they want to achieve upon retirement – a significantly higher proportion than for other generations.

When asked to rate their top priorities in retirement planning, 78 per cent of millennials were likely to select legacy and wealth transfer as one of their top two – also higher than the percentage for other generations.

Savvy investors and planners

This strong desire among millennials to leave behind a financial legacy may be partly attributable to their present life stage.

“This generation is delaying life milestones such as getting married or starting a family, which may affect their priorities and timeline on financial and legacy planning,” said Ong.

Those in the Gen Z cohort, on the other hand, might be more focused on their immediate financial needs, Ong noted. Gen X and senior cohorts, meanwhile, may have begun planning for their retirement years during earlier stages of life, and their current focus might have shifted.

Indeed, the sentiment survey also found 81 per cent of those in Gen X were concerned about costs related to retirement. “Healthcare affordability is a large concern for Gen Xs and seniors, with medical costs in Singapore increasing year on year,” said Ong.

At the same time, he noted that millennials are a highly educated generation. “As millennials get older and gain more earning power, they are increasingly attuned towards financial planning to help manage their savings and investments.

“With the advent of technology, millennials have gained increased access to financial information and tools. This opens doors in terms of investment opportunities, enhances overall financial literacy and makes it easier for them to make informed investment decisions.”

In the survey, millennials also reported the highest levels of confidence in handling certain financial tasks. For instance, 74 per cent said they were confident with investing and 82 per cent said they were confident with budgeting. In comparison, the average confidence level for all respondents was 64 per cent for investing and 77 per cent for budgeting.

“Millennials are expected to put a greater focus on growing and preserving their wealth to pass this on to future generations. This can be done through good financial planning, uptake of life policies, and investing in insurance such as investment-linked policies,” said Ong.

Among the 27 per cent of respondents who said they plan to use investment-linked products for retirement, more than 40 per cent were millennials. This group was also the most likely to use such products for legacy planning, and to ensure their loved ones are financially protected.

“By having greater awareness of how they can achieve their financial goals through sustainable investment strategies, millennials will then be able to meet their objectives and needs in their golden years,” he added.

Plan early, review regularly

A qualified actuary with more than 27 years of experience in the financial services and insurance industry, Ong has witnessed some of the pitfalls of failing to plan adequately for one’s financial legacy.

“Without a well-structured legacy plan, family members and loved ones may find themselves spending significant time and resources trying to sort out the distribution of inheritance,” he said.

He added that many often postpone their legacy planning as they view it as a “distant concern”. Unfortunately, this means families may find themselves financially unprepared to navigate sudden changes such as financial setbacks or sudden deaths.

“It is also important for individuals to regularly review their financial situations. Everyone goes through different life milestones and changes, and circumstances may change quickly, hence it is essential to adapt one’s legacy plan to align with one’s latest financial situation,” he added.

Another common mistake is the “failure to protect one’s savings by taking into consideration accidents and long-term medical care expenses”, which could force families or individuals to use money that was meant to be passed on.

Beyond taking care of the finances, Ong said it is also important to plan for permanent incapacity and to mentally prepare loved ones for the prospect of inheriting wealth.

“Putting together advanced medical directives, a lasting power of attorney or an advanced care plan can help manage difficult decisions in the event of severe illness,” he said.

Those who plan to pass on their wealth, meanwhile, should provide support and knowledge to their beneficiaries.

“Inheritance can come with significant tax implications, so consulting a tax adviser can help one understand and plan for any potential liabilities,” Ong said.

Beneficiaries should also understand the specifics of their inheritance, including stipulations and clauses that might come with it.

“This includes understanding any specific conditions, restrictions or obligations outlined in the will or trust. These conditions might affect how and when the inheritance can be accessed, used or invested.”

Ong added that it is important for beneficiaries to view an inheritance as an opportunity to strategically plan for their own futures, rather than as a means of immediate gratification.

“For instance, beneficiaries should consider using inheritance as a springboard for smart investments and long-term growth, and can speak to a financial adviser who can help to provide strategic plans regarding their financial future.”

Legacy planning for all

Although the number of individuals who express interest in legacy planning is high, Ong hopes to encourage more people to think about it and act on such thoughts.

“A common misconception is that legacy planning is only necessary for the wealthy, and individuals with fewer assets don’t need to plan. However, this is not true.”

Legacy planning, Ong said, involves evaluating and organising all aspects of one’s financials: from bank accounts and investments, to insurance policies, Central Provident Fund balances, property, businesses and debts.

“Opportunities to diversify and build their investment portfolios across different asset classes, risk levels and markets, based on their investment goals and time horizon will also help,” he added.

“Investment-linked insurance policies, for example, can be a simple way that one can grow wealth while staying protected over the years, while still accumulating wealth for themselves and the next generation.

“Having a diversified investment portfolio can help to mitigate risks and potentially generate higher returns. It can also provide flexibility in meeting different financial needs.”

The good news is that millennials are keen learners. When asked which retirement topics they were most interested in, millennials were the most likely group to choose estate planning and inheritance.

Ong said this bodes well for future generations. “Not only will (the millennial generation) be able to benefit from the great wealth transfer, they will also move towards creating generational wealth for the next generation.”

Source link