An Untraditional Roadmap To Financial Success In Your 20s

Do you want to achieve financial success in your 20s? Believe it or not, you can make good money at a young age and by taking an untraditional route. Here’s one woman’s story on how she was able to reach a $200,000+ net worth by age 29. Perhaps her story will inspire you to achieve financial success in your 20s as well.

When I read Sam’s post on how to make a six-figure salary, I had a strong (negative) reaction to the advice given. I’ve done just about everything wrong according to his advice.

Yet, at age 29 I have a six-figure salary and $200k in net worth. While I’ve experienced enough privilege in my life to go through college with my tuition paid by my parents, I’m not a trust fund baby.

A Middle Class Upbringing

I grew up in a pretty average middle class household. Went to public school all my life, and assumed that the business world was for people not like myself. I’ve also always excelled in the arts, being accepted into prestigious programs for painting, drama and writing. But, due to a combination of ADD, depression, and anxiety, my academic performance never quite reflected my intellectual potential.

With that, I didn’t graduate from an Ivy League School. I finished four years at large private college with a degree in the arts. When I graduated college in 2005, I had no idea what to do, or how to make money, let alone save it and invest for retirement.

Sam explains that the best way to get a six-figure income is to do well in high school, get into a top-tier college. And then be the best in any one of a large number of professions (medicine, law finance, high tech, public servant etc).

I wouldn’t say this is terrible advice, as this strategy clearly helps many people get ahead. But, not having Harvard or Berkeley on your diploma doesn’t mean that you’ll always be stuck earning $50k a year. Nor does it mean that you should ignore putting money away for old age before it’s too late. You can achieve financial success in your 20s no matter where you went to college.

Decisions Impact Financial Success In Your 20s

Unlike me, my boyfriend followed all the “right” steps, graduating from a prestigious institution with high honors. Yet, he has spent the past decade unemployed or underemployed. He has no savings and only a part-time job on his resume.

I’ve built up my career from scratch and comparatively speaking am doing much better off with my 3.2 from an unknown school versus his 3.8 from a top-tier institution. Grades matter. But, what also matters is drive, stamina, and motivation. And above all else, faith that the stars will align if you refuse to give up.

I’ve had my fair share of professional ups and downs in my career to date. But, regardless of the turbulence I try and save a significant portion of my income. I’m not frugal by any means (if you read my blog you’ll know that I also spend a significant chunk of change on shopping).

But, even so I’ve always focused on living under my means. I know many just-out-of-college or young professionals who buy a new car off the bat and then complain about their monthly car payments. It’s strange.

Here’s how much to save by age 25. It’s the start of your career, so you had best get going.

Anyone Can Achieve A Six-Figure Salary

I argue that anyone can obtain a six-figure salary. But, you have to be prepared to work hard, take risks, and shut out any fear you have of the unknown. It also helps not to have kids too young if you want to reach financial success in your 20s. As I understand that the cost and responsibility of taking care of kids makes this a lot more challenging. If you have a choice, I’d recommend to wait to have kids until you’re in your 30s if you want to earn financial security.

Can anyone become rich if they want to? Sam says, “There is No Monopoly on Being Rich.” He argues that if you work hard and believe that you can be wealthy, you can be “rich.” I don’t think anyone can be rich in the financial sense. But, a good 75% of people have the ability to be doing better than they are. Where I live, where basic houses start at $700k, a $100k salary does not make you rich. The wealth comes from saving and spending smartly, and making the right financial decisions.

While not everyone can be a millionaire, anyone can improve their current networth by focusing on becoming really good at one thing that they’re passionate about and that is a marketable skill. With that, anyone can be financially secure and have enough for a solid retirement.

Use Grit To Achieve Financial Success In Your 20s

This is my story since graduation, from $15k to $100k in annual salary, and $8k to $200k in net worth before 30. I hope it inspires you to achieve financial success in your 20s as well.

2005: Unemployed, Overwhelmed With $8k Savings

I knew I didn’t want to move back home. But, I didn’t know what I wanted to do. The year following my college graduation was extremely rough. I pushed myself out of my comfort zone by refusing to move back in with my family after college graduation despite having no job opportunities on the table. The first year out of college I must have earned about $15k from freelance income and a part-time admin job that I despised. I’ll admit, that year was extremely rough.

Almost a year after graduating, I found myself in a deep depression. I had a “worthless” liberal arts degree from a no-name college outside of the city it resided in. This quickly became clear as I sent out hundreds upon hundreds of resumes with no one biting.

I even felt Ivy Envy at the time. (I don’t actually think my liberal arts degree was useless, but at the time it felt like it as it provided no help to getting a job. Graduating without a job lined up can make financial success in your 20s feel darn near impossible. But, the key is to never give up and use rejections as motivation to try harder.

What I learned in my college years, however, made me who I am today and helped me once I actually got my jobs.) My non-profit internships were apparently not relevant work experience for any of the positions that piqued my interest.

My Big Break

After eight extremely stressful months I got my big break — a $30k per year FT job. The skies parted. I thought $30k was incredible. It would cover my $450 a month rent and gas. At that point I wasn’t even considering a saving plan let alone investing for retirement. But what I felt was hope. Once you land a full-time job, you’ll start believing financial success in your 20s is possible too.

However, I knew nothing about investing. This was ironic since I grew up with a father who made a living as an actuary. He gave advice on pension plans for big companies. My mother’s only involvement with our household finances was spending them and getting yelled at for doing so.

Yet, my dad didn’t explain anything about money to either of us. We were fortunate in that with his income we were able to live a comfortable upper middle class life. But, he didn’t provide a clear picture on how to continue that lifestyle when detached from the family. Personal finance isn’t taught in school. So all too often, you can be stuck figuring out how to achieve financial success in your 20s all by yourself. That’s what happened to me.

Shortly after graduating from college, I had one meeting with a big bank financial representative. She told me about their mutual fund offerings as well as the safety of CDs. I had $8k in savings at the time, thanks to a lawsuit I had won as a child and parents who so kindly paid my way through school. So, I put my proceeds into a CD to forget about for a rainy day.

Putting Money To Work

Most of my income went to my basic bills and living expenses. With the money left over, I just kept it in a checking out. No one taught me anything about investing, and my work did not have a 401k so there was no option to save for retirement at my job. The checking account seemed like a great place to store the leftovers.

It was about that time when I somehow found myself reading a blog called Her English Major’s Money. Unlike many personal finance blogs that were about debt, her blog was about getting a small inheritance and figuring out what to do with it. Her other posts discussed basic investing topics such as IRAs and stocks. I then realized that personal finance was important to think about now, versus later.

I opened my first Vanguard Roth IRA with the $3000 I had managed to save in my checking account. Finally, I felt accomplished. But, at the same time hopeless, given I’d learned that in order to retire you need over $1 million.

$3k was just a drop in a very large bucket that was impossible to fill. Shortly after finding this blog, I decided to start my own. I had no one to talk about these very important matters with and realized I needed to educate myself before it was too late.

2006: The Ball Starts Rolling

After a year at my first job, I was recruited for a role that I wasn’t really qualified for. I accepted the new position for $50k. Skies parted again. Getting a promotion and a raise is a huge confidence boost. I guarantee when you hit that milestone, you’ll start feeling financial success in your 20s.

Suddenly I could max out the entire $5k amount the government let me put into a Roth IRA for the year. It still felt like nothing, but being able to “max out” my yearly contribution made me feel smart. I gave myself a little pat on the back.

Then, I decided it was time to move out of my $450 a month teeny tiny room in a 4br apartment and into my own studio. I found one that was reasonably nice for $900 a month. Moving in on my own reflected a major transition in my life.

But, at the same time I was struggling with my job. I realized that it wasn’t right for me, and the company and I decided to mutually part ways. What I should have done was engineer my own layoff. Then I could have left amicably with money in my pocket and bought myself more time.

I was back to square one, but with $900 a month rent to pay versus $450. Suddenly my small checking account cushion was shrinking. It takes grit to stay on the path to financial success in your 20s. I never said it would be easy.

Freelancing To Startup

It really took a solid two years after graduation before I found my footing. I started freelancing for various companies in the area — writing a little content for this, doing a little basic design work for that. There’s always opportunities to do small projects for people, especially if you’re a reasonably good writer.

I’d make $50 here, $25 there, and built up my portfolio and experience. I figured out that, as lazy and worthless as I thought I was, due to the depression, I really liked working. I enjoyed creating something from nothing, and it didn’t hurt that I was being paid for it.

After a few years of dabbling in this and that, I received a job offer for a part-time, not-so-amazingly-well-paid writing position at a startup. No benefits. I was making something like $30 an hour at the time. It wasn’t a lot but I was able to cover my basic costs. Over a year of part-time work I managed to build the position into a full time job where I was managing customer service requests and more.

I was willing to do just about anything that was needed. This was often a lot since our entire team was just 10 people. I stayed in that position for a good three years, with a $65k salary. Unfortunately, I never got a raise or a bonus. But what that $65k provided was the ability to start exploring investing.

While I still had no access to a 401k, I opened a trading account and started to invest in ETFs and stocks. I was nervous when I had $1000 in that account, spread across about 6 different funds. I started to put more and more money into the account, as it was exciting to watch the stocks move up, and up, and up. Until they didn’t.

2008: It Was All Going So Well…

2008 rolls around and the stock market crashes. My investments – the little of them that there were – suffered with the markets like everyone else’s. In tandem, my rent had skyrocketed from $900 to $1300 for the same studio apartment in two years due to another company buying the property. I decided I needed to make significant changes to my life because I wasn’t about to spend $1.3k a month making $65k a year.

So, I said goodbye to solo living and moved into an apartment with roommates again, albeit nicer than the first place I lived with 4 roommates, and brought my rent down to about $600 a month. About that time, my company started to lay off employees who weren’t technical to make themselves attractive for an acquisition, and given we had only ten employees and most were technical, I was one of the first to be let go.

It was the best thing that could have happened to me, even though it did not feel that way at the time. I admittedly fell into a depression and thought about how I would have to go back to the beginning again, after three years of loyal employment and hard work. My boss told me that he was sorry that he had to let me go, it was clearly a necessity for the business, and I tried to remind myself of the fact as I went back to sending out hundreds upon hundreds of resumes.

Losing More Money

I could have applied for unemployment but didn’t end up taking any money from the government, as I felt if I went on unemployment it would be too easy to let myself just get by on the little that it paid. By 2009, my networth had dropped from $30k to $25k. Then, thankfully, the skies parted again for a second time. All of my dedication to sending out resume after resume paid off. My unique background made me just as employable for the right positions as it made me unemployable for the wrong positions.

It was about this time when I started to get exciting consulting positions and opportunities. I decided the only way to get ahead in life was to start to believe in myself. In one month I had two amazing opportunities. In addition, I started to negotiate and sell myself for what I’m worth. I worked a lot hourly, earning an average of $80 per hour. All together, I earned about $120k in one year across multiple positions. One company sent me to work internationally for an entire month.

This was also the first year I had access to a 401k. I maxed it out in six months. I put a lot of the excess into stocks. My life then seemed relatively cheap compared to my earnings. I didn’t go out and buy a new car or move into a more expensive place, instead I took the excess money and put it into my investment accounts.

It was a good time to do this as the market recovered from rock bottom. I started getting serious about budgeting. Unfortunately, I still spent more than I should have on things I don’t need. But my fixed costs were low. I was still driving the car I bought in 2006 used (a ’99) for $8k. This year was the year I really transformed from a scared kid into an adult. I was 25.

From 2010-2011: Increasing My Net Worth From $25K to $200k

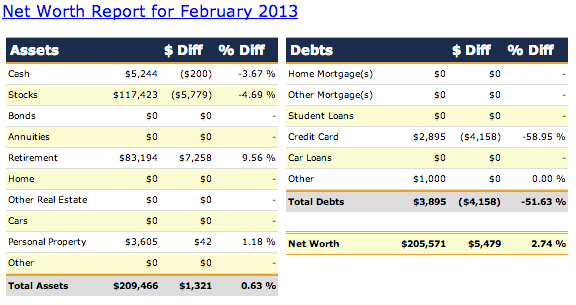

2010: $88.6k networth composed of $8.7k cash, $38.2k stocks, $8.1k CDs, $2.1k 529 account, and $41.3k retirement (I also set aside cash for taxes which had leftovers that went into my 2011 Roth right away.

I owned $15.4k of AAPL stock and the rest of my taxable portfolio was spread out over COMV, ENOC, EPI, EWZ, GE, GLD, GOOG, IHI, JNJ, KOL, MCD, PBD, PG, T, VWO, VZ, WFMI, and XLF. My Roth account included DVY, SPY, GLD, SLV and VNQ. I had $18.6k in my 401k, $9.5k + $7.1k in two Vanguard funds in a Roth IRA.

2011: $145k networth, with $9.9k in cash, $88.7k in taxable account stocks, $3325 in the 529 account, $43.7k in retirement. Also gained $20k in stock options (which I exercised/paid for, so I count them in my overall networth – I don’t count the ones I haven’t exercised yet.

That could be worth $0k or over a million dollars, but I don’t want to expect anything, so I just count what I paid for it.) In my taxable account, I sold stocks that were total losers and invested the proceeds 50% into AAPL and another 50% into two other large cap stocks or ETFs. I closed the year with $30k in AAPL stock, owning AMZN, AND, CSCO, CVX, ENOC, EPI, EWZ, GE, GLD, GOOG, IHI, JNJ, KOL, MCD, PBD, PG, SBUX, T, VWO, VZ and XLF.

I’m Proof Financial Success In Your 20s Is Possible

By 2012 I had a $202.5k networth, with $5.7k cash, $124.2k stocks, $73.8k retirement, and $3.5k in my 529 account. Sold a lot of losers. Bought my 100th share of AAPL stock. Luckily I only bought two shares at about $650 right before it crashed down to $450. My average AAPL share cost $340, so I’m still ahead, knock on wood. Closed out 2012 with $59.6k of AAPL.

Yes, I wish I sold then, but oh well. Even without selling at the top, AAPL still helped me increase my networth about $20k last year above what I saved, enabling me to hit my goal. Admittedly, I would have saved more had my AAPL stock not kept going up and made my networth look so inflated!

By the end of 2012, I closed the year owning shares of AMZN, CBOU, GE, GOOG, HAO, IHI, INTC, JNJ, KO, MCD, MSFT, PG, SBUX, T, VWO, VZ, and WFMI. My IRA accounts stayed pretty stable, I just put more money into the funds, focusing on dividend-earning, REITs and metal funds since those get taxed high in taxable accounts.

I’m also considering selling my stocks and purchasing property, but I haven’t decided yet if that makes any sense. Renting cheaply has helped me get to where I am today in my net worth and ownership seems like a waste of money. I’m so busy working I have no time to take care of myself let alone a house.

2013: Finding My Own Definition of Success

In the years since, I’ve found myself and my career. I love what I do and the people I work with. I found that small businesses appreciate my relentless passion and dedication to execution. Although I was offered a position at a large company which paid well, against the advice of my career counselor, I opted to accept a role at a very young company where I would have a lot of opportunity to play a role in the success of the business. That risk was the best decision of my life.

I still struggle with depression and anxiety. But I’m working hard on becoming more confident and to stop feeling like an imposter. I try to fake it until I make it. I remind myself that if I’m actually not doing a good job – if I’m actually a talentless impostor – than the very smart people who I work for would not keep me around.

If they’re happy with my work, clearly I’m doing something right. It’s extremely hard to accept that, but I know I have to in order to move up in the business world. As one of the few females in the industry, I feel like I owe it to myself to not let insecurity get in the way of my own success.

I hope to have a $250k net worth by the start of 2014, and start my 30s off as a quarter-millionaire. It’s crazy to think this is possible to achieve, especially given the ups and downs of the last 8 years. Seeing this is possible makes me feel like anything is possible. And, with the exception of certain tenuous circumstances, it is. You don’t need an extra fancy degree to make it happen. You need intellect, creativity and tenacity. The rest will fall into place.

Further Reading

Start An Online Business

Sam here. It’s been over six years since I started Financial Samurai and I’m actually earning a good passive and active income stream online now. The top 1% of all posts on Financial Samurai generates 31% of all traffic and revenue.

I never thought I’d be able to quit my job in 2012 just three years after starting Financial Samurai. But by starting one financial crisis day in 2009, Financial Samurai actually makes more than my entire passive income total that took 15 years to build. If you enjoy writing, creating, connecting with people online, and enjoying more freedom, see how you can set up a WordPress blog in 15 minutes like mine with my step-by-step tutorial.

You never know where the journey will take you. In 2015, I fulfilled a bucket list item by visiting the ancient temples of Angkor Wat in Cambodia, while stopping over at the DMZ in Korea, and attending a friends wedding in Malaysia. Starting this website is the best career/ lifestyle move I’ve ever made.

Track Your Wealth For Free And Achieve Financial Success In Your 20s

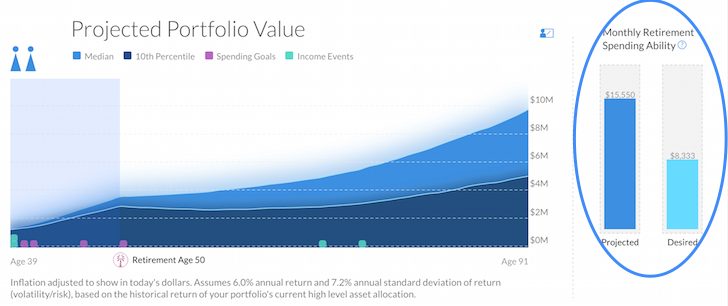

In order to optimize your finances, you’ve first got to track your finances. I recommend signing up for Empower‘s free financial tools so you can track your net worth, analyze your investment portfolios for excessive fees, and run your financials through their fantastic Retirement Planning Calculator.

Those who are on top of their finances build much greater wealth longer term than those who don’t. I’ve used Empower since 2012. It’s the best free financial app out there to manage your money.

Source link